Markets are ever-changing, and our experts take that into consideration to provide the most comprehensive and timely views. Stay up to date with the latest trends and analyses to ensure you have every tool at your disposal to make critical investment decisions.

Our Thinking

View all of our latest thinking on the subjects that matter most to you

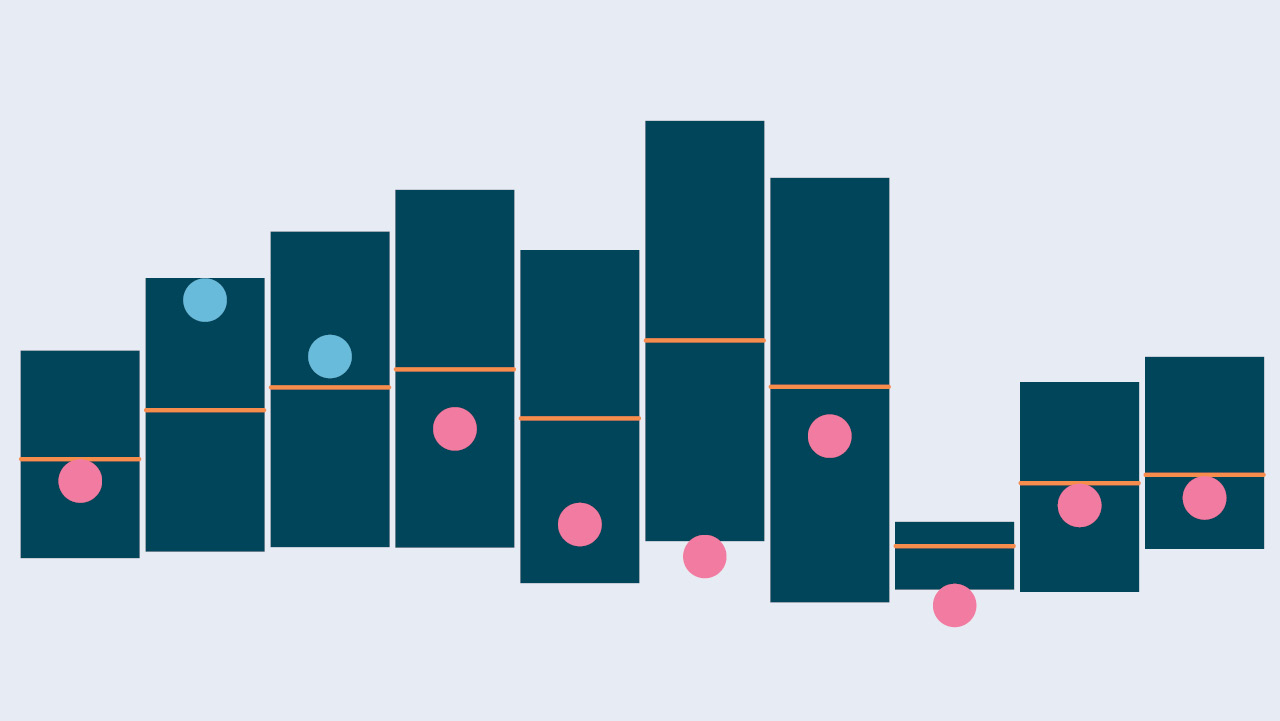

Investment and Market Updates

Our View

Strategy

Our View

Access our latest thinking on everything from markets to wealth planning. Our thought leadership offers valuable insights from industry veterans, ensuring you have the necessary tools and information to navigate the future.

Active Wealth

Our View

At BNY Mellon Wealth Management, we consider wealth planning to be a multi-dimensional process. Learn how to implement a dynamic approach that takes into consideration borrowing, investing, spending, managing taxes and costs, and protecting wealth for future generations.

Advice for Business Owners

Our View

Running a business is an intricate process that deserves special attention. Learn about key strategies for business owners, from tax management to selling or transferring ownership of a business.

Want to Know More?