The 2024 edition of our 10-Year Capital Market Assumptions (CMAs) offers our projections for asset class returns, volatilities and correlations over the next decade. This yearly exercise helps in shaping the design of our investors’ long-term portfolios.

Download the Full Report

Download a Summary

Executive Summary

Every year BNY Mellon develops Capital Market Assumptions (CMAs) for 46 asset classes across equities, fixed income and alternatives. The CMAs cover a 10-year forward investment time horizon and incorporate the macroeconomic forecasts generated by the BNY Mellon Investment Management Global Economic and Investment Analysis Group. The return and risk assumptions are intended to guide investors in the development of long-term strategic asset allocations.

Key Takeaways:

• After a tumultuous period of monetary policy tightening, evidence of slowing inflation is gaining traction across many economies. Central banks are expected to start lowering interest rates in 2024, however we expect interest rates to remain at higher levels than over the decade or so following the Global Financial Crisis.

• Many assumptions now reflect moderately higher returns and volatility, in part driven by the current high-rate environment.

• U.S. equity returns are expected to improve on higher valuation adjustments, where the economy is well-positioned to benefit from growth, including new technological innovations, such as AI.

• Bonds should benefit from higher current yields and the potential for an easier rate path as inflation eases and the output gap widens.

• Alternatives may outperform as the rise in economic distress and asset price dislocations from higher interest rates increases the opportunity set for hedge funds and private asset managers to generate alpha.

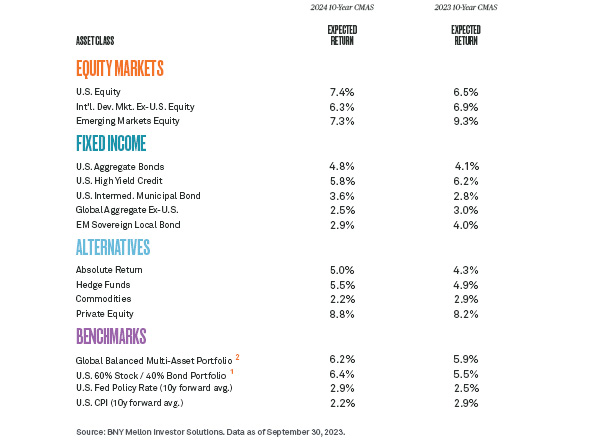

Moderately Higher Returns for Several Key Assets

Equities: We see moderately higher returns for several key assets compared to last year’s edition. For U.S. equities, an improved economic outlook compared to the 2023 edition has raised our assumption for ten year returns to 7.4%, from 6.5% previously. Outside of the U.S., global equities may have to navigate a more bifurcated and uncertain range of economic scenarios.

Bonds: It has been a grueling three years for fixed income investors, but higher starting yields reduce the risk of further disappointments. A macroeconomic backdrop in which U.S. inflation has moderated substantially raises the likelihood of gradually lower interest rates, and thus fixed-income yields, in the years ahead. Accordingly, we see U.S. aggregate bond returns of 4.8% over the next ten years, compared to 4.1% last year.

60/40: Better return prospects from U.S. equities and fixed income accordingly mean that we see 6.4% returns over the next ten years from the traditional U.S. 60% Stock/40% Bond Portfolio1, up from the 5.5% assumption last year.

Snapshot of 2024 vs. 2023 10-Year Capital Market Return Assumptions

1Assumes a hypothetical stock/bond portfolio with weights of 60% U.S. large cap equity and 40% U.S. aggregate investment grade bonds.

2Assumes a hypothetical balanced portfolio with weights of 20% U.S. large cap equity, 7% U.S. mid cap equity, 4% U.S. small cap equity, 16% international developed equity, 6% emerging equity, 2% U.S. REIT, 25% U.S. Aggregate fixed income, 5% U.S. high yield, and 15% hedge funds.

Note: The portfolio presented herein is not representative of a specific strategy managed by BNY Mellon Investor Solutions, LLC as of the date of this publication and is not intended to constitute an advertisement of a specific BNY Mellon Investor Solutions, LLC product or service; instead, all information, content and materials are for general informational purposes only.

Key Themes for the Next Decade

Our report explores four key social, economic, technological and environmental themes that we believe will drive capital market returns over the coming decade and beyond:

1- Accelerating Impact of an Aging Population

2- Higher for Longer (Real) Interest Rates and Deglobalization

3- Productivity and Disinflationary Promises of AI

4- Unprecedented Investment in Lower Carbon Policies

A Time-Tested Approach That Approximates Real-World Results

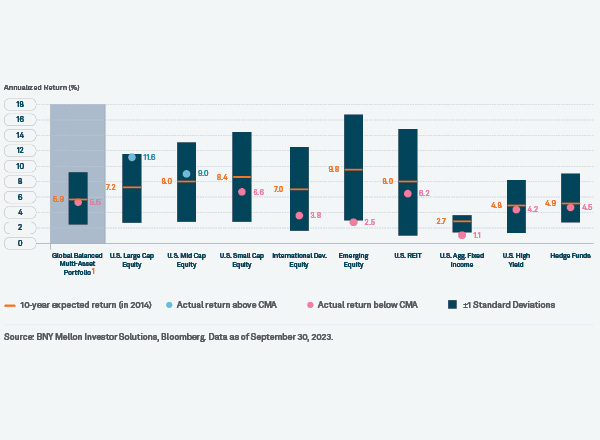

For decades, BNY Mellon has developed CMAs to guide our institutional and high net worth clients in structuring their long-term asset allocations. Time is the ultimate arbiter of the accuracy of our long-term CMAs, as it allows us to validate our prior return assumptions against realized market returns in the subsequent ten years.

In the most recently completed 10-year period, we have found that our 10-year expected returns (published in 2014) served as a relatively accurate assumption, with observed returns for nearly all major asset classes within one standard deviation of our ex ante assumption. Two exceptions where our assumptions were too optimistic were Emerging Market Equities (where the consumer demographic super-cycle thesis failed to take hold) and U.S. Aggregate Fixed Income (where a rate hike cycle not seen in decades crushed fixed income returns in the final year of the window).

2014 Capital Market Return Assumptions vs. Actual 10-Year Returns

1Assumes a hypothetical stock/bond portfolio with weights of 60% U.S. large cap equity and 40% U.S. aggregate investment grade bonds.

2Assumes a hypothetical balanced portfolio with weights of 20% U.S. large cap equity, 7% U.S. mid cap equity, 4% U.S. small cap equity, 16% international developed equity, 6% emerging equity, 2% U.S. REIT, 25% U.S. Aggregate fixed income, 5% U.S. high yield, and 15% hedge funds.

Note: The portfolio presented herein is not representative of a specific strategy managed by BNY Mellon Investor Solutions, LLC as of the date of this publication and is not intended to constitute an advertisement of a specific BNY Mellon Investor Solutions, LLC product or service; instead, all information, content and materials are for general informational purposes only.

The Use of Capital Market Assumptions

These CMAs serve as a useful guide for our internal investment teams across BNY Mellon as well as our clients, partners, and academic colleagues. While each year’s edition of our 10-year assumptions is highly anticipated, it’s important to observe that, for the most part and in most years, the changes are evolutionary not revolutionary. While we always seek to employ new and better ways to make our assumptions more accurate, we are cognizant of the value of consistency in methodology over time.

CMAs are utilized across a range of investment and planning activities. These assumptions influence our strategic asset allocation models, which are tailored to our clients’ objectives, risk tolerance and tax sensitivity. From this starting point, we recommend tactical asset allocation shifts based on shorter-term market dislocations. CMAs also provide an important input for other aspects of clients’ wealth, such as developing a spending plan, managing for taxes or borrowing.

Download the Full Report

Download a Summary

This material is provided for educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice and may not be used as such. Effort has been made to assure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. We recommend all individuals consult with their lawyer or tax professional, or their investment or financial advisor for professional assurance that this material, and the interpretation of it, is accurate and appropriate for their unique situation. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. Trademarks and logos belong to their respective owners.

The information is current as of November 2023. It is based on sources believed to be reliable, but its accuracy is not guaranteed.

© 2023 The Bank of New York Mellon Corporation. All rights reserved. | WIS-458094-2023-11-15 WM-458043-2023-11-15