For bond investors taking advantage of the high yields available in cash, now is the time to buy bonds.

For over a year, cash has been a comfortable place to sit for many investors, with cash earning over 5%, its highest in over a decade. Meanwhile, after a rough start to 2023, bonds delivered positive total returns for the year, aided by a sharp move lower in Treasury yields. The rally in bonds began in early November as inflation continued to moderate, and it gathered even more momentum after an unexpected pivot from the Federal Reserve at its December policy meeting.

With the federal funds rate having peaked, investors in cash should consider extending duration by reallocating into short- to intermediate-term bonds and bond funds. Though the Fed has yet to declare victory in the fight against inflation, the central bank has signaled rate cuts are on the horizon in 2024 as long as disinflation continues. As a result, investors have a narrow window to take advantage of historically attractive yields and potential capital appreciation in the bond market.

Staying in Cash Carries Risks

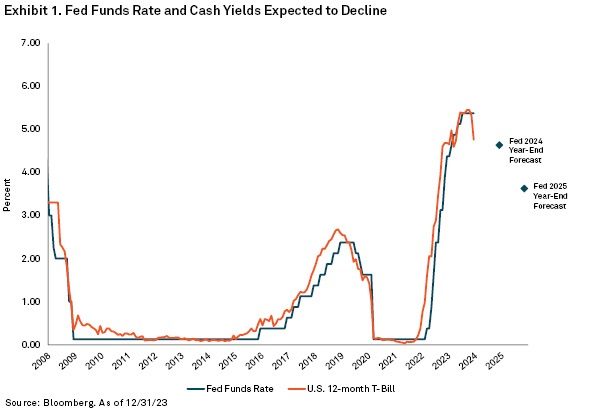

Exhibit 1 shows the expected path of the federal funds rate as well as the 1-year Treasury bill (a proxy for cash), which are highly correlated. The federal funds rate is expected to decline to 3.6% by the end of 2025. Although reinvestment risk has not been a primary concern for investors since the Fed started raising rates, that is starting to change.

An Attractive Entry Point

Although Treasury yields have recently declined, they remain near decade highs. Treasuries across the curve offer yields between 3.90% and 4.35%, and investment grade corporate bonds offer an average yield of 5.20%. Meanwhile, yields on an actively managed, high-quality intermediate municipal bond portfolio currently range from 3.00% to 3.25%. For individuals living in a high-income tax state, such as New York, New Jersey or California, that’s about 6.25% on a tax-equivalent basis for an investor in the top tax bracket.

A bond’s current yield is not the sole consideration when investing; the underlying value upon purchase matters just as much. There are two components of bond returns: income from payments and changes in price. Bonds pay a fixed interest rate or coupon, which becomes more attractive when interest rates fall, driving up demand and the price of the bond. However, the value of a bond decreases when interest rates rise. If the economy slows over the coming quarters, as we expect, and interest rates decline, these higher starting yields, along with appreciation, will deliver attractive total returns.

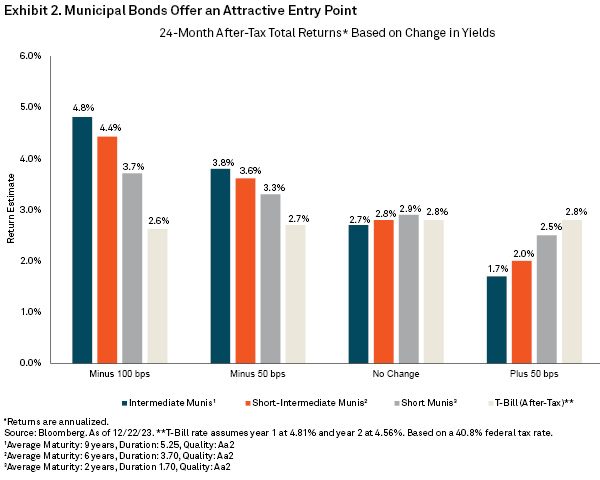

As Exhibit 2 illustrates, we believe municipal bonds currently offer an attractive risk/reward trade-off for long-term investors. The chart displays potential annualized total returns for municipal bonds of different short and intermediate maturities compared to cash, considering a change in yields over the next 24 months.

A move lower in yields of 50 basis points should produce positive returns of 3.3% to 3.8% for municipal bonds, compared to 2.7% for cash. For an investor in the highest income tax bracket, an intermediate municipal bond can generate an attractive after-tax return of 4.8% given a 100 basis point (or 1%) move in yields. That’s almost twice as much as cash. If yields hold steady, annualized returns on munis over the next two years should be in the range of 2.7% to 2.9% depending on the maturity. Even if yields were to increase, returns would remain positive as higher starting yields help to offset any price depreciation. Importantly, with attractive yields available across the municipal yield curve, investors do not need to take on much more risk to outperform cash.

Take Advantage of Peak Rates

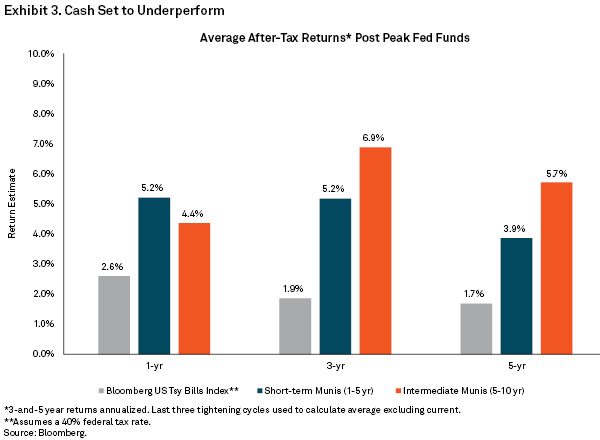

History suggests that when the Fed is at peak rates, short- and intermediate-term bonds and bond funds beat cash. In past tightening cycles, yields have typically fallen in the 12 months following peak federal funds rates. As seen in Exhibit 3, in the 1, 3 and 5 years that followed peak fed funds rates, average annualized returns for short-term bonds (1-5 years) and intermediate-term bonds (5-10 years) outperformed 1-year Treasury bills on an after-tax basis due to higher starting yields. Over a five-year period, intermediate-term bonds delivered more than three times the return of 1-year Treasury bills on an after-tax basis.

Don’t Miss Out on Today’s Higher Bond Yields

Although interest rate volatility may persist, the longer an investor stays in cash, the greater the risk of missing out on today’s higher bond yields. We offer a range of actively managed fixed income solutions, which can be customized to your risk tolerance and goals, and they hold the potential to outperform cash over the long run. If you are sitting in cash, it may be time to find another chair.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

©2024 The Bank of New York Mellon Corporation. All rights reserved. WI-474371-2024-01-02