Technology makes our lives easier, but at what expense?

In George Orwell’s 1949 dystopian sci-fi novel, Nineteen Eighty-Four, Big Brother is always watching. The government uses telescreens (two-way televisions), cameras and hidden microphones to keep tabs on its citizens, ensuring that no one thinks or says anything misaligned with the ruling party’s ideology.

While the book is clearly fiction, we have reached the point of technological advancement where it is possible. However, the real issue today is the unauthorized use of personal data for commercial or criminal intent. Similar to Nineteen Eighty-Four, our mobile devices have cameras and microphones that monitor our actions and discussions.

Whether it’s our search history, or a conversation with a friend, mobile devices store this data and share it with various apps and websites. So, what can you do to retake control of your personal data?

Privacy Controls

Whether you’re an Android devotee or Apple iOS enthusiast, your mobile device comes with a host of privacy settings that allow you to disable camera and microphone access for specific apps.

Android users can find these preferences by going to their device’s settings, clicking privacy and viewing their privacy dashboard, which shows which permissions your apps can access as well as when they are using them. Within the privacy dashboard, you can revoke access to these permissions for specific apps. Permissions like location and microphone access can be used in real time to spy on where you are and what you’re doing, making a thorough review of your privacy dashboard critical.

To manage permissions on iOS, the process is similar. You can access them via settings and then by clicking privacy and security; that displays a list of permissions, such as camera, microphone and location access, which you can turn off for each of your apps. However, device settings are not your only line of defense.

The following entails the simplest way to manage permission controls (camera, microphone and location) on your Android or iPhone:

1See footnote at end of page.

You should also be cognizant of your privacy settings on frequently visited websites, such as search engines, social networks and mobile banking sites. For example, Google is an ever-swelling repository of emails, photos and other forms of data you may have forgotten about. To manage privacy settings on Google, go to myaccount.google.com and select the data & privacy tab.

The Social Network

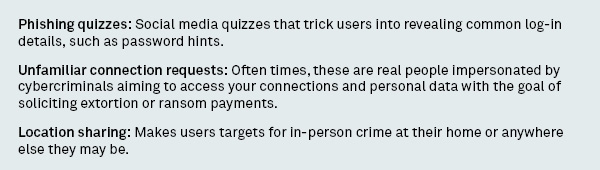

Although search engines retain ample amounts of personal data, an area of recent concern has been social networks. What started as a harmless way for friends, families and colleagues to stay connected has become a hotbed for fraud. Three common risks include:

Best practices to avoid social media attacks include placing strong security controls on your accounts to minimize what is shared publicly, using unique passphrases for each of your social media platforms, and manually turning on multi-factor authentication on each of your social media accounts.

While the list of best practices is even more extensive, these are simple measures you can implement today. When in doubt, review the privacy settings of your social media accounts to adjust what and how much you share.

Data Brokers

You can also request for data collection sites to remove your information. The more time you spend on social media, or online, the more your information is circulating the web.

Data brokers, which number in the thousands, typically purchase information on individuals from corporations. This includes the posts you’ve made or liked, online quizzes you’ve taken, online sweepstakes you’ve entered and the websites you’ve visited. Additionally, they gather public information on you, such as birth certificates and bankruptcy records, as well as financial data, like money owed on a department store credit card and items purchased with a store’s loyalty card. While BNY Mellon never shares client information or data with third parties, an abundance of accessible data from other sources could allow cybercriminals to target you and your assets.

However, you can contact data brokers directly and request your data, opt out of their information mining services, or pay a private company to remove data. You can also adjust your online behavior, use a privacy-focused browser, or use a virtual private network (VPN) to hide your IP address.

Virtual Private Networks (VPN)

Because websites, internet service providers (ISPs) or anyone connected to your network can see your browsing activity and collect personal data through your computer’s IP address (or virtual ID), private browsers do not protect you from snooping. However, a VPN can offer anonymity by masking your IP address from everyone except for the VPN provider.

Although many VPNs are available for use, it’s important to avoid free options because many contain malware. You should choose one that suits your budget and needs, and sign up for a trial to assess the speed beforehand.

Consistency is Key

While privacy measures are important to practice year round, in light of October being Cybersecurity Awareness Month, there are a few things you should know. During the holiday season, under the guise of shipping notices, deals and charities, criminals often prey on innocent consumers with malware and direct them toward phishing sites that steal personal information.

Aside from sticking to reputable retailers and ensuring the websites you visit are secure (there should be an “s” after the “http” at the beginning of the URL: e.g., https), you can protect yourself with the methods mentioned above, such as using privacy controls, managing your personal data online and using a VPN when shopping. And while these techniques are helpful, remember that we also have you covered.

BNY Mellon is committed to protecting your data and account information, which it never shares with third parties. BNY Mellon’s Enterprise Resiliency Office works in coordination with our digital and technology teams to deliver timely and effective incident identification, assessment, escalation, communication and resolution. We do this with the goal of providing clients with superior service as well as world-class products and services.

Footnotes:

1Settings may differ depending on operating systems and system upgrades.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment, or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorized Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

The information in this paper is as of October 2023 and is based on sources believed to be reliable but content accuracy is not guaranteed.

©2023 The Bank of New York Mellon Corporation. All rights reserved. WM-433197-2023-10-05