AI continues to dominate headlines and drive equity markets. We discuss how Generative AI (Gen-AI) will change how we live and work, its potential impacts to the economy, industries and financial markets, and why investors should have exposure to this theme.

Key Takeaways

- Artificial Intelligence (AI) is the simulation of human intelligence by machines. Generative AI (Gen-AI) is a significant enhancement and allows models to take a vast amount of data and “generate” new ideas, products, outcomes and opportunities.

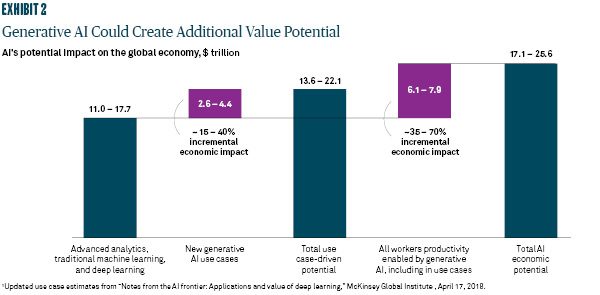

- McKinsey estimated AI’s affect to productivity and revenue opportunities by 2030 could add $13.6T to $22.1T in economic value versus today’s global GDP, while having a limited effect on total employment levels. PwC also estimated AI could have a transformational impact on global growth; approximating economic activity could increase by $15.7T by 2030 given AI’s broad usage and expected pace of adoption.

- We are in the early stages of the largest technology investment cycle ever and it will be critical for investors to have exposure to this investment theme over the next decade.

AI Takes Center Stage

Artificial Intelligence (AI) grabbed the spotlight in 2023, as the media, individuals and investors were excited about how the new technology could shape the future. The truth is, AI is not as new as it seems. At its core, AI is the simulation of human intelligence by machines. For years, companies have automated processes and used pre-determined intelligence with functions like virtual assistants, speech recognition and predictive maintenance.

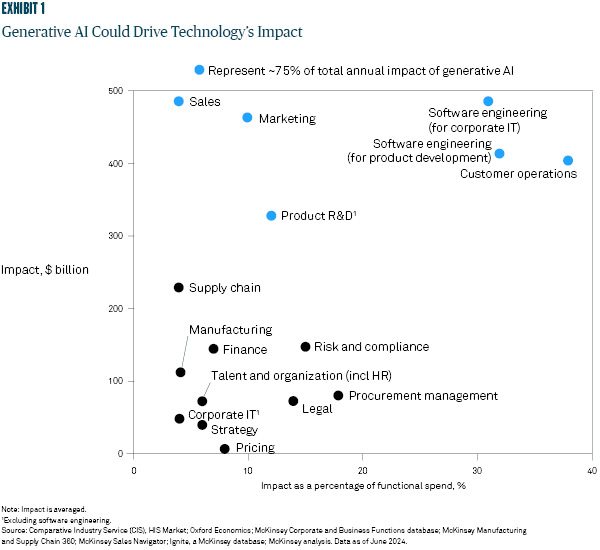

However, recent improvements in computing power, data availability and complex algorithms, has led the industry to innovate and develop Generative AI (Gen-AI). Gen-AI is a significant enhancement and allows models to take a vast amount of data and “generate” new ideas, products, outcomes and opportunities. Gen-AI makes the technology applicable to nearly every employee in every industry and will likely have a more significant effect of any technology in terms of productivity improvements and revenue opportunity creation.

How We’ll Use Gen-AI

Simply put, Gen-AI is likely to experience mass adoption based on its vast number of use cases. This is what makes Gen-AI so unique and such a massive opportunity. Every industry and every business have a unique set of data they can leverage to make critical and strategic decisions. Organizations are increasingly using data for business decisions (supply chain, sales, marketing, product development, workforce empowerment goals, accounting, etc.), and these decisions are becoming more complex as we transition to a more data-driven world.

Gen-AI’s Impact on GDP Growth

In terms of Gen-AI’s adoption curve, the speed at which ChatGPT has been adopted by 1 million users is strong proof that there is massive interest. McKinsey recently conducted extensive scenario stress tests that analyzed adoption rates based on a country’s employment base and technological maturity, implementation levels within different industries, usage rates within different employee layers of a company, and government regulation and citizen pushbacks on a per-country basis. Given these numerous variables, McKinsey estimated the effect to productivity and revenue opportunities by 2030 could add $13.6T to $22.1T in economic value versus today’s global GDP, while having a limited effect on total employment levels. This equates to a 1.3%-2.1% uplift in global GDP growth per year.

To put this into context, other transformational advancements pale in comparison. Examples include the steam engine in the 1800s, robot automation in the early 1990s, early IT adoption in the late 1990s and the Internet in the 2000s, which lifted global GDP by +0.3%, +0.4%, +0.6% and +0.7%, respectively. AI is expected to be so much more effective due to its usefulness across all facets of businesses in every industry, the faster adoption curve already being witnessed and the technology’s ability to need less technical expertise to use effectively. PwC believes the economic tailwinds could be greater, with a projection of $15.6T.

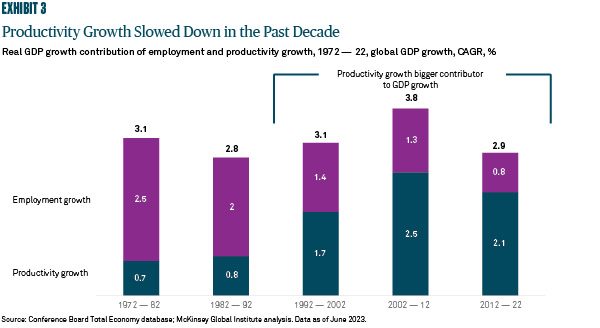

Productivity growth has been the main engine of GDP growth over the past three decades, but has slowed in the last decade. AI has the potential to be a tailwind to improve worker productivity in decades to come. We believe we are entering a revolutionary period where AI will reshape the working landscape.

Investment, Beneficiaries, and Disruption

Expectations for AI investment spending is robust. Statista predicts AI spending will increase from just over $100B in 2022 to $1.9T in 2030. This would suggest AI spending increases from less than 2% of overall IT budgets to over 6%, representing one of the fastest adopted technologies ever.

Meaningful advancements inevitably cause disruption and a change in the marketplace. Examples within Technology include the mainframe moving to PC, the adoption of the internet, and the move from independent data centers to a cloud infrastructure. All these transitions created new revenue opportunities. Many legacy firms struggled to adapt, allowing newer, nimbler and more technologically advanced companies to thrive. As Gen-AI gains momentum, it is likely incumbents will find themselves being competitively displaced, thus creating opportunities for well-funded private companies. It is very possible some of the largest companies at the end of this decade are relatively unknown today.

What companies stand to benefit? An example would be a pharmaceutical company that is able to leverage Gen-AI during drug development to improve drug design, chemical synthesis, and drug screening, thus researching, testing, and developing at a faster pace with greater accuracy and improving its time-to-market. Another example would be a technology company using Gen-AI for software development and leveraging its customer installed base and usage trends to develop additional features/functionality, introduce new pricing tiers, and enter new markets. These company-specific actions would distance themselves from the competition and create competitive advantages difficult to replicate given the companies’ unique data sets.

Potential Beneficiaries

We expect the benefits of Gen-AI to be far reaching and impact every industry on a global basis. However, we expect the technology sector to have the most immediate and visible impact. Within technology, we can simplify the AI investment opportunity set into three categories: infrastructure suppliers, infrastructure and large language model vendors, and application stock. While we list examples of beneficiaries, this is not an exhaustive list.

- Infrastructure Suppliers: This layer includes the chip designers, chip manufacturers, and others that provide capabilities to develop the infrastructure. It includes companies like Nvidia, Taiwan Semiconductor, and Broadcom.

- Infrastructure and Large Language Model Vendors: The second layer is the infrastructure and the large language models that are used for training and inference capabilities. This includes companies like Microsoft, Amazon, Google and OpenAI.

- Application Stack: The third layer is the application stack, where companies leverage Gen-AI into their own products and create deeper competitive moats. This layer is far more dynamic and less clear as to who the beneficiaries will be. Many investors consider companies like Microsoft and Meta as early leaders in AI monetization.

- Organizations are in the beginning of the adoption phase and history suggests newer, more advanced companies will emerge over the next few years and disrupt and displace incumbents across several markets. Recognizing the shifts in the competitive landscape and the new market opportunities being created will be the key challenge for investors going forward.

Headwinds, Potential Risks, and Limiting Factors

There are several factors and potential risks that are likely to cause headwinds towards AI adoption and usage. Below are several factors to consider.

- Government Regulation: The regulatory and policy landscape for AI is an emerging issue globally. Intellectual Property, privacy, ethics, and contractual liability risks may require assessment as the pending AI regulations become effective and the legal environment evolves across jurisdictions.

- Public Concerns: Does AI remove people from daily activities? Does it complicate and confuse people on what is real and what is manipulated? Does it pose an existential risk?

- Ethical Concerns: AI will be used for military applications; it can manipulate human behavior, and can make decisions that are void of compassion. Additionally, AI likely widens the wealth gap, not just within individual countries, but also between established and emerging markets. How does society weigh the pros/cons of this technology?

- Bias/Transparency: For most AI applications, results are based on the data, which can be inaccurate or have biases.

- Data Privacy and Intellectual Property Ownership: The New York Times recently sued Microsoft and OpenAI for copyright infringement. How do companies protect their own intellectual property, how do models ingest enough data to be useful, and how do we protect this vast amount of data to stop mass data leaks and hacks?

How Investors Can Benefit from AI Opportunities

From a big picture viewpoint, we anticipate AI to be a generational opportunity improving productivity and creating new revenue opportunities — more than any other technology, including the internet. We expect Gen-AI to alter how companies go to market, build their products, service their customers and operate/transact daily.

From a micro viewpoint, we are looking for companies that can leverage their proprietary data, create deeper competitive moats and compound their AI investments into additional products and market opportunities. More specifically, within technology, we see companies with unique products supporting the build out of the AI ecosystem as the clearest beneficiaries of this trend, but also anticipate those that can further differentiate their products using Gen-AI being able to have greater success monetizing additional features/functionality.

We are in the early stages of the largest technology investment cycle ever and it will be critical for investors to have exposure to this investment theme over the next decade.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

©2024 The Bank of New York Mellon Corporation. All rights reserved. WI-WM-WI-510297-2024-03-07