The rating change may create opportunities for investors.

August 3, 2023

The United States is no longer a member of the elite club of countries with at least two AAA credit ratings now that Fitch Ratings has downgraded the federal government’s credit score to AA+.

The move comes three months after Fitch put the U.S. on notice for a downgrade during May’s debt ceiling impasse and follows Standard & Poor’s downgrade of Treasury credit to AA+ in 2011. Only Moody’s Investors Service retains its highest AAA rating on U.S. debt.

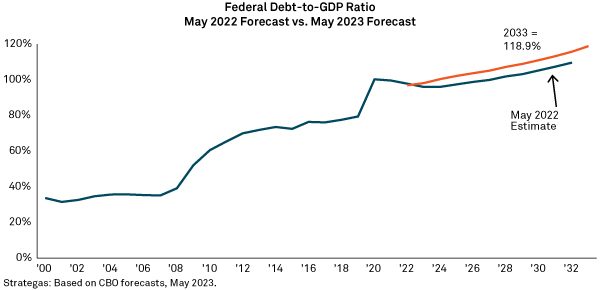

Fitch said it made the move because of the federal government’s “expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers.” Fitch cited the Congressional Budget Office’s latest forecast that the federal government’s debt-to-GDP ratio will increase to 118% of GDP by 2025 from a pre-Covid level of 100%. The median for other AAA-rated countries is 40%.1

Exhibit 1: U.S. Fiscal Health is Forecast to Worsen

How Did Markets React?

The yield on the 10-year Treasury pushed through 4% this week to highs not seen since November. While the downgrade contributed to the volatility, the rise in yields (as bond prices fell) was largely driven by the U.S. Treasury’s announcement of some $1 trillion of net new supply for the third quarter, as well as a strong private payroll report.

Stocks struggled as the 10-year rose, prompting a long-awaited bout of consolidation after rallying for months. Equities have shown weakness in the past when the 10-year note has moved above 4%, only to continue rallying on economic soft-landing expectations when yields fall again.

Treasury Market’s Global Status Unaffected by Downgrade

The downgrade is unlikely to impact the U.S. Treasury market's status in the global capital markets. Treasuries have always been and remain the largest high quality liquid pool of risk-free government securities. There is no other developed market rated AA+ or higher that can accommodate a sudden rush of global demand during a risk-off event.

Its position as the world’s safe haven of choice for central banks, corporations and asset managers is one reason why the U.S. had been able to carry a higher debt-to-GDP ratio than its AAA-rated peers for so long.

As Treasury Secretary Janet Yellen noted: Fitch’s decision would “not change what Americans, investors, and people all around the world already know: That Treasury securities remain the world’s pre-eminent safe and liquid asset, and that the American economy is fundamentally strong.”

The main issue with a credit downgrade is whether it creates forced sellers of Treasuries. That hasn’t happened, because Fitch flagged its concerns several months ago, giving investors ample time to change the wording of their investment mandates to “Treasuries” rather than “AAA credit” to avoid forced selling.

What Does the Downgrade Mean for Investors?

It’s understandable that investors would use higher yields as a reason to take profits in the equity market. Stocks were due for a pullback, and higher yields can hurt earnings for companies that have large borrowing needs.

However, we think the bias to the upside in stocks over the longer-term is still intact. Earnings estimates have stabilized and the broadening of the rally to include more sectors and stocks beyond the 10 largest in the S&P 500 is a good sign that equities may have more room to run.

Given our expectation that longer-term bond yields will trend down now that the Fed is at or near the peak in rates, Fitch’s downgrade provides an opportunity for investors to lock in decade-high yields. History shows that after the Fed reaches peak rates at the end of a tightening cycle, intermediate- and long-term bond yields begin to decline and significantly outperform cash on a total return basis.

1. Fitch Ratings, "Fitch Downgrades the United States’ Long-Term Ratings to ‘AA+’ from ‘AAA’; Outlook Stable." Aug. 1, 2023.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorized Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

©2023 The Bank of New York Mellon Corporation. All rights reserved. WI-411864-2023-08-03