Look past the political noise and focus on what really matters to markets: earnings and interest rates.

October 2, 2023

A U.S. federal government shutdown has been averted. Congress passed a stopgap funding bill just before its deadline on September 30, which will keep the government open until mid-November.

But the overarching problem remains. Although the government will continue operating until November 17, Congress needs to agree on a budget for its current fiscal year, which began on October 1, or another stopgap measure by the mid-November deadline. If it fails on both counts, lawmakers will force the government into its fourth shutdown in the past 10 years.

The stock market’s initial reaction to the news from Washington was muted. And if history is a guide, a government shutdown (if it occurs) should have a minimal impact on the economy and stocks.

However, if a shutdown occurs, there is a possibility it could be more disruptive this time. The economy is already wrestling with macro shocks, such as higher oil prices, an auto strike and the restart of student loan debt payments. Additionally, investor sentiment has been dampened by rising bond yields and the slower pace of anticipated rate cuts signaled by the Federal Reserve (the Fed) in its recent summary of economic projections.

Impact on the Economy and the Stock Market

In general, shutdowns tend to be less disruptive than investors fear because only a small portion of the government is affected. Non-essential services, like museums and national parks, are suspended while critical functions like air traffic control, social security and healthcare services continue to operate. A shutdown does not affect state and local functions, and unlike the debt ceiling debate earlier this year, there is no risk the Treasury Department will stop paying the bills.

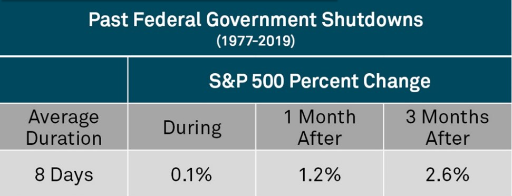

Shutdowns are usually short lived, lasting an average of eight days since the 1970s. More recent shutdowns have averaged about two weeks, except for one that lasted 35 days from late 2018 into early 2019. In that case, 75% of the government was still financed.

Research also suggests that stocks are not significantly impacted. Since 1977, data shows an even split between gains and losses during these shutdowns, with the S&P 500 flat on average. The S&P 500 has gained 1.2% on average one month after the end of a shutdown and 2.6% after three months.

Source: Strategas

A Prolonged Shutdown Comes with Risks

If the shutdown occurs and is prolonged, the U.S. could lose its last AAA credit rating from Moody’s, potentially leading to more volatility. A confluence of other factors, including rising oil prices and the impact of union strikes, could also exacerbate investor concerns.

Additionally, a drawn-out shutdown would delay the release of critical macro data that the Fed factors into its interest rate decisions.

Stay the Course

We continue to monitor developments in Washington closely. However, we believe investors should look past the political noise and stay the course, as the shutdown should not pose a serious threat to markets and the economy. Investors should focus on what really matters in the weeks ahead: third quarter earnings and greater clarity from the Fed on the timing of rate cuts.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

©2023 The Bank of New York Mellon Corporation. All rights reserved. WI-431335-2023-10-02