A Dovish Fed Pivot

December 19, 2023

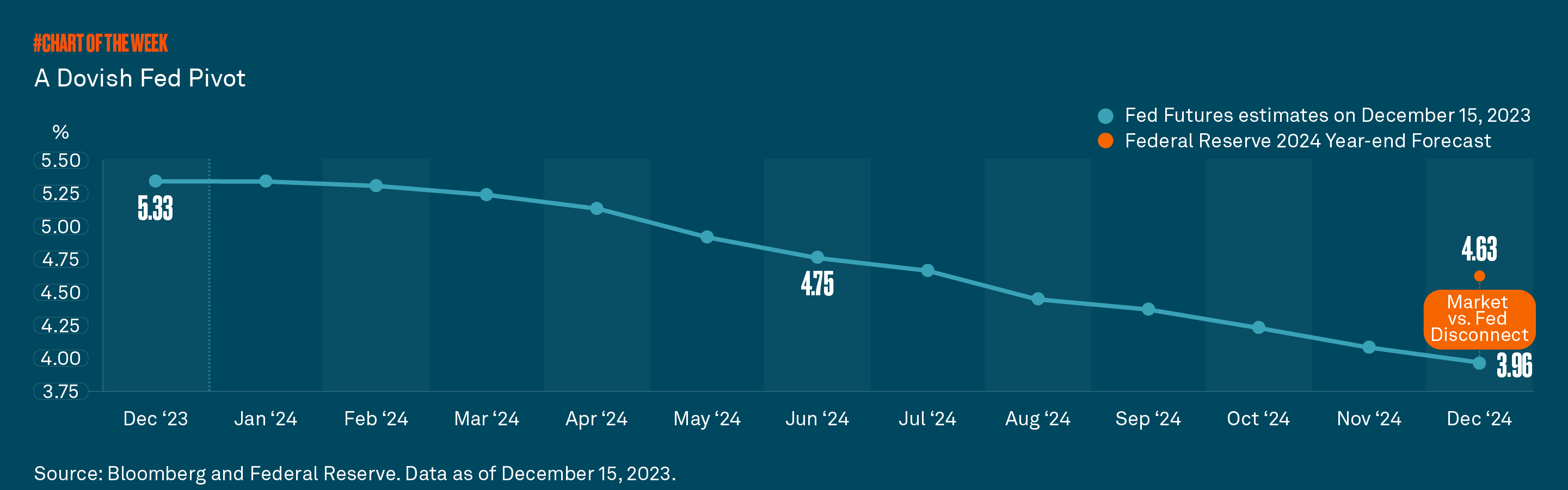

The Federal Reserve kept the federal funds rate unchanged at 5.25% - 5.50% at its December policy meeting. However, the Federal Open Market Committee’s (FOMC) updated Summary of Economic Projections (SEP) implied that rate hikes were over and cuts were on the way. The Fed lowered its 2024 year-end federal funds rate forecast to 4.6%, down 50 basis points (bps) from September’s projection of 5.1%. During the press conference, Fed Chair Jerome Powell’s comments added to the risk-on sentiment when he reinforced that Fed officials are now discussing the prospect for cutting rates.

The news reverberated through the fixed income and equity markets. Treasury yields plunged across the curve. The two-year Treasury note, which is most sensitive to monetary policy, fell over 25 bps on Wednesday, while the 10-year Treasury note yield declined 15 bps to just over 4%.

Stocks enjoyed a broad-based rally on the week with several indices hitting new milestones: the Dow Jones Industrial Average broke through 37,000 for the first time and the S&P 500 hit a two-year high. There was also a clear rotation, with sectors that have lagged year to date, such as financials, health care and small caps, participating in the rally.

The futures market has pulled the timing of rate cuts forward and now expects 150 bps of cuts in 2024, beginning in March. This is more dovish than the Fed’s 75 bps of cuts, which could be a source of disconnect for markets moving forward. In fact, New York Fed President John Williams took the opportunity on Friday to suggest a March cut was not likely.

One takeaway from the updated SEP is that a soft landing now appears to be the Fed’s base case. We agree, as our outlook for 2024 is a healthy slowdown and further moderation of inflation. However, we are not as optimistic as the market on the magnitude and timing of cuts. We are forecasting 100 bps of rate cuts, beginning as early as the spring. As a result, investors should enjoy positive single-digit returns across most asset classes in the new year.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. ©2023 The Bank of New York Mellon Corporation. All rights reserved. WI-471186-2023-12-18