Study Reveals Succession Disconnect

Between Next Gen Individuals

and Family Offices

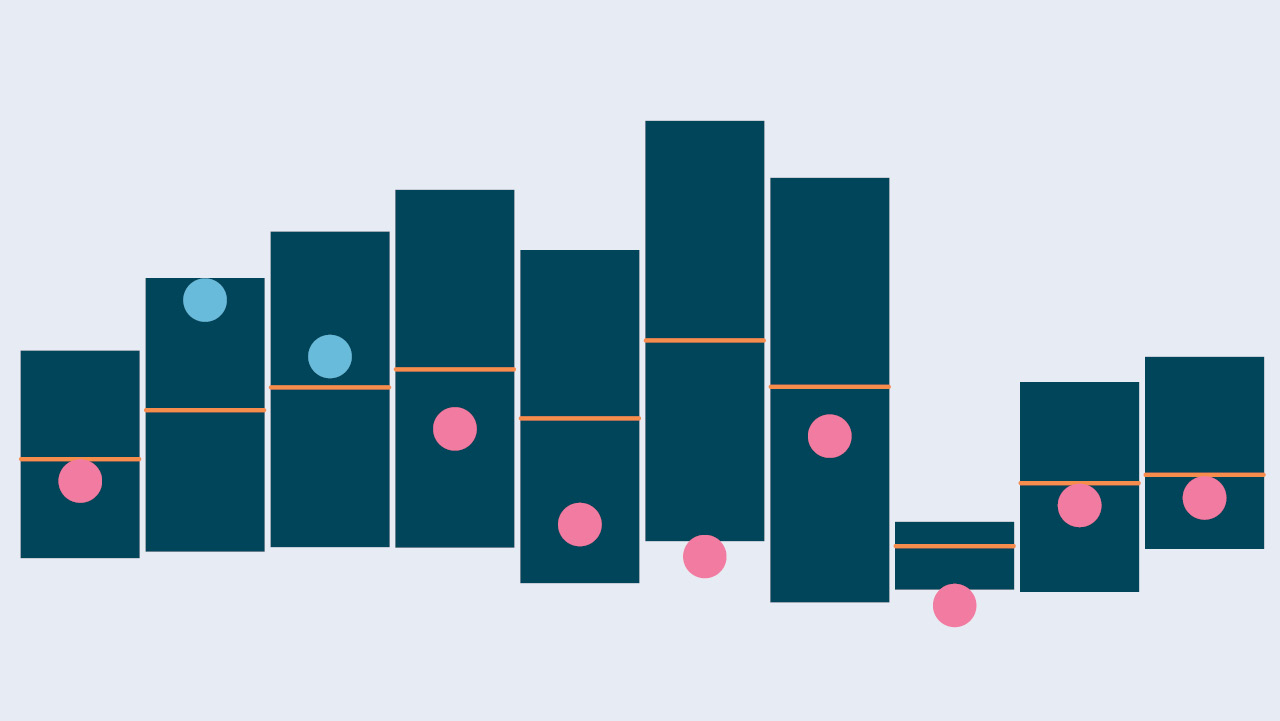

85% of Ultra-High-Net-Worth Next Gens Confident About Preparation for Succession, While Family Offices Believe 39% Are Prepared

New York, Dec. 20, 2022 – In a new study from BNY Mellon Wealth Management and Campden Wealth, the next generation of ultra-high-net-worth individuals (UHNWI) overwhelmingly indicate they are ready for succession in the family enterprise, with 85% reporting they feel either very or somewhat prepared. Yet, Campden Wealth’s 2022 research on family offices suggest that a clear disconnect exists, as only 39% of family offices believe Next Gens are adequately prepared for succession.[1]

The study, “The Next Generation of Wealth Holders in the United States 2022,” surveyed 100+ next generation UHNWIs (Next Gens) with a total estimated family net worth of US$77 billion (average US$752 million per family), all of whom have recently or will in the future assume control of the family wealth.

“Being in the midst of the largest wealth transfer in U.S. history, the next generation of wealth holders understand and embrace the gravity of this significant responsibility for a long-lasting family legacy,” says Dr. Rebecca Gooch, Director of Research at Campden Wealth. “They want to live up to their families’ expectations and make a positive impact on the world, but face challenges with a successful transition based on complicated family dynamics, understanding their role post-succession and the absence of a formally written succession plan.”

Next Gens Are Eager to Get Involved in Strategic and Finance-related Roles, but Family Conflicts Impede Succession Planning Preparedness

Next Gens’ involvement in the family enterprise gives them firsthand knowledge of its goals. They have an appetite to get more involved, with a preference toward strategic and finance-related positions, ranking investment strategy/management on top (42%), followed by financial planning (38%), and succession planning (38%).

The study found Next Gens have an interest in easing conflict within the family enterprise. Two thirds (66%) believe in the power of regular communication and another 63% seek external support for their succession planning/wealth transfers. Despite respondents’ eagerness to engage, their family members’ roles and responsibilities (41%) and concerns over business strategy (36%) pose obstacles to a smooth wealth transfer.

“Having worked over the past two centuries with ultra-high-net-worth individuals and family offices that span multiple generations, in some instances up to six generations, we have seen firsthand a willingness from Next Gen clients to be open to formal education, continued learning and community-building to ensure the successful transfer of wealth,” said Ben McGloin, Head of Advice, Planning & Fiduciary Services, BNY Mellon Wealth Management. “We have helped to support and work through the family dynamics between Next Gen clients and family members with the pressures accompanying succession and inheriting multigenerational wealth.”

Switching to a More Growth-oriented Investment Strategy Is a Top Priority When Taking Control of the Family Enterprise

Despite some concerns about their preparedness, Next Gens have an appetite for growth and vision for shaking up the family enterprise. Once in control, 27% plan to shift towards alternative investments (e.g., private markets, hedge funds, commodities), while another 24% want to integrate new technologies (e.g., blockchain, artificial intelligence) into the family office.

Driven by a desire to diversify from traditional investments (78%) and to invest in an area before it becomes mainstream (70%), respondents see value in investing in digital assets/new tech when assuming control. Within the next year, Next Gens plan to increase their exposure to artificial intelligence (60%), fintech (60%), and robotics (53%). When it comes to cryptocurrency, those active in the space plan to stay committed, with more than half (57%) willing to maintain and 43% planning to increase investments in cryptocurrency.

Furthermore, more than half of respondents surveyed (51%) believe one does not have to sacrifice returns to invest sustainably and more than two-thirds (68%) assert that sustainable investing has become a permanent feature of the investment landscape. Sustainability will likely be a bigger proportion of Next Gens’ portfolios, with respondents expecting 43% of their average portfolio to be dedicated to sustainability five years from now versus, on average, 17% of their portfolio to sustainability today.

“In line with the study, we have seen many of our Next Gen wealth clients approach their investing strategy with a growth-oriented mindset and a profound sensitivity and passion for inclusion of sustainable investing,” says Leo Grohowski, Chief Investment Officer at BNY Mellon Wealth Management. “Next Gens are also breaking the mold from their parents’ generation by embracing alternatives and new technologies, but are being thoughtful and measured regarding the inclusion of digital assets in their portfolios.”

The full 2022 Next Gen study, which includes 12 in-depth interviews with Next Gen family members and forms the basis of several case studies that provide deeper insights into the trends outlined by survey responses, are available here.

About “The Next Generation of Wealth Holders in the United States” Survey Methodology

This study is based on quantitative and qualitative data sourced by Campden Wealth. Between March and July 2022, 102 surveys were collected from UHNWI in the United States with a family net worth in excess of US$30 million (average net worth per family, US$752 million), all of whom have recently or will in the future assume control of the family wealth and/or the family business or family office. The generations that dominate the sample are Millennials (44%) and Gen X (33%), which account for over three-quarters of all respondents. We define Millennials as anyone born from 1981 to 1995 and Gen X as anyone born from 1965 to 1980.

About BNY Mellon Wealth Management

For more than two centuries, BNY Mellon Wealth Management has provided services to financially successful individuals and families, their family offices and business enterprises, planned giving programs, and endowments and foundations. It has $256 billion in total client assets as of September 30, 2022, and an extensive network of offices in the U.S. and internationally. BNY Mellon Wealth Management, which delivers leading wealth advice across investments, banking, custody, and wealth and estate planning, conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. A line of business within Wealth Management, BNY Mellon Investor Solutions includes the firm’s institutional multi-asset solutions business. The Investor Solutions AUM/AUA is $26.5bn as of September 30, 2022. For more information, visit www.bnymellonwealth.com or follow us on LinkedIn at https://www.linkedin.com/company/bnymellonwealthmanagement/mycompany or Twitter @BNYMellonWealth.

About Campden Wealth

Campden Wealth is a family-owned, global membership organization providing education, research, and networking opportunities to families of significant wealth, supporting their critical decisions, helping to achieve enduring success for their enterprises, family offices and safeguarding their family legacy.

The Campden Club is a private, qualified, invitation only Members club. Representing 1,400 multi-generational business-owning families, family offices and private investors across 39 countries. The Club delivers peer networking, bespoke connections, shared knowledge, and best practices. Campden Club members also enjoy privileged access to generational education programmes held in collaboration with leading global universities.

Campden Research supplies market insight on key sector issues for its client community and their advisors and suppliers. Through in-depth studies and comprehensive methodologies, Campden Research provides unique proprietary data and analysis based on primary sources.

Campden Education delivers a virtual training platform empowering families with practical knowledge and the tools to make informed decisions. Drawing on deep expertise and real-world experiences, our programs are designed to guide the whole family through all stages of ownership and growth.

Campden Wealth owns the Institute for Private Investors (IPI), the pre-eminent membership network for private investors in the United States founded in 1991. In 2015, Campden Wealth further enhanced its international reach with the establishment of Campden Family Connect PVT. Ltd., a joint venture with the Patni family in Mumbai. For more information: research@campdenwealth.com

Media Contact:

Alexis Donofrio

Vice President, Prosek Partners

646-818-9282

adonofrio@pro-bny.com

Dr. Rebecca Gooch

Senior Director of Research, Campden Wealth

+44 (0) 7771 917076

rebeccagooch@campdenwealth.com

Legal Notice

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views, insights and positioning statements expressed within this material are those of the 102 next generation wealth holders and not necessarily those of BNY Mellon. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

[1] Campden Wealth/RBC, The North America Family Office Report 2022.Article Text