Gain first-hand insight into the minds of ultra high-net-worth Next Gen wealth owners.

Executive Summary

Over the next two decades, it’s estimated that Baby Boomers will pass along nearly $84 trillion in wealth to their heirs and charities, with Generation X being the largest recipient.* With so much at stake during the “Great Wealth Transfer,” BNY Mellon Wealth Management partnered with Campden Wealth to conduct a comprehensive study capturing the attitudes and experiences of the next generation (“Next Gen”) of ultra-high-net-worth (UHNW) individuals.

These Next Gen wealth owners and inheritors are next in line to assume control of the family enterprise, which includes the family wealth, family business and/or family office.

Read the full report The Next Generation of Wealth Holders in the United States.

State of Preparedness

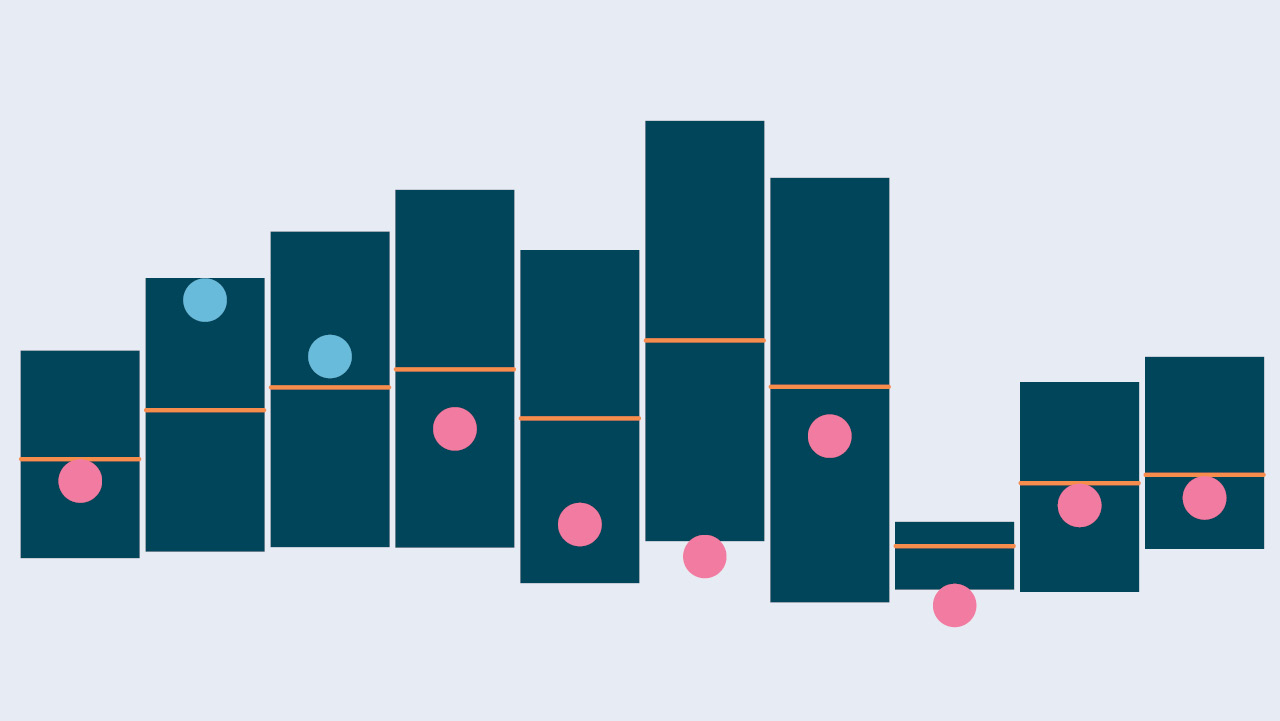

Next Gens may appear ready, but they admit they don’t always feel ready. Only 37% of respondents feel very prepared for succession, compared with 52% who state they feel somewhat prepared or even unprepared. The report also shows that only a third (33%) of represented families have a formally written succession plan in place. The remaining families are still developing their succession plans, rely on informal/verbal agreements, or have no plan at all.

Our findings suggest that Next Gens are highly educated, and most of them actively engage in the family office or family business (86% and 55%, respectively). They also don’t shy away from hard work.

Key Takeaways

Looking for expert advice: Expert advice is most needed in the areas of trust/estate planning and tax planning/mitigation, according to 99% and 97% of respondents, respectively. Notably, a significant 32% of those with family net worth below US$250 million confess they do not currently have their own wealth manager.

Knowing early, inheriting late: On average, Next Gens first learn about their family wealth at the age of 25. They expect to assume control (or have assumed control) of the family wealth by age 48.

Committing to the family enterprise: Post succession, over half of Next Gens (51%) plan to work in the family office, followed by 40% who plan to work in family philanthropy, and 33% in the family business.

Tackling family conflict: Nearly half of Next Gens (46%) believe that excessive wealth can lead to family infighting, while 44% have already experienced wealth-related family disputes.

Prioritizing cybersecurity: Nearly a third of Next Gens surveyed (31%) say improving cybersecurity is critical when taking charge of the family business/family office.

A desire to give back: Next Gens understand that wealth is a privilege, with a notable 82% being active in philanthropy.

Sustainable investing is here to stay: Over half (56%) of Next Gens currently invest sustainably, while 68% assert that sustainable investing has become a permanent feature of the investment landscape.

Higher risk appetite: 34% of Next Gens report that switching to a more growth-oriented investment strategy will be their top priority when taking control of the family office/business.

About the Study

This study is based on quantitative and qualitative data sourced by Campden Wealth. Between March and July 2022, 102 surveys were collected from next generation wealth holders in the United States with a family net worth in excess of US$30 million – all of whom have recently or will soon assume control of the family wealth and/or the family business or family office.

What’s Next for Next Gen

The next generation is fueled by a desire for change and positive impact. Having dealt with crises before, they are keen to implement their vision for the family enterprise. Doing so, they prioritize hard work, family unity, and the well-being of our planet.

To learn the perspectives of more than 100 UHNW Next Gen decision makers across all major geographic regions, please read our full report The Next Generation of Wealth Holders in the United States.

Footnotes

*Cerulli Associates: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2021.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not in-tended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation.

The Bank of New York Mellon, DIFC Branch (the “Authorized Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE.

The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners.

© 2022 The Bank of New York Mellon Corporation. All rights reserved. | WM-323703-2022-11-22