IDGTs provide wealthy individuals a powerful planning tool in their effort to maximize assets for the next generation.

Intentionally Defective Grantor Trusts (IDGTs) are one of the premier vehicles for affluent families to transfer their wealth to the next generation without incurring gift or estate taxes. An IDGT is an irrevocable trust created by an individual (the "grantor") during life. Assets transferred to an IDGT (cash, marketable securities, interest in a closely held business, etc.) exist outside of the grantor's estate for estate and gift-tax purposes but, because the trust is "defective" for income tax purposes, any income associated with such assets will be taxed directly to the grantor, not the trust.

Thoughtful planning with an IDGT can take advantage of this bifurcated tax treatment. This means that any future appreciation of transferred assets will occur outside of the grantor's estate while payment by the grantor of the trust's annual income tax liability is akin to a tax-free gift to the trust.

Utilizing an IDGT is often the next step in a well-considered estate plan after the preparation of traditional wills, financial powers of attorney and documents related to health care.

Here are some of the reasons IDGTs can have such a big impact on an estate plan, as well as a few ways planners can magnify the trust's benefits in appropriate situations:

Income tax liability

Although IDGTs involve federal estate and gift-tax planning, it is the trust's income tax characteristics that differentiate it from other planning options. This tax treatment enhances the growth of the trust's assets, as the trust is able to grow free from the drag of income tax.

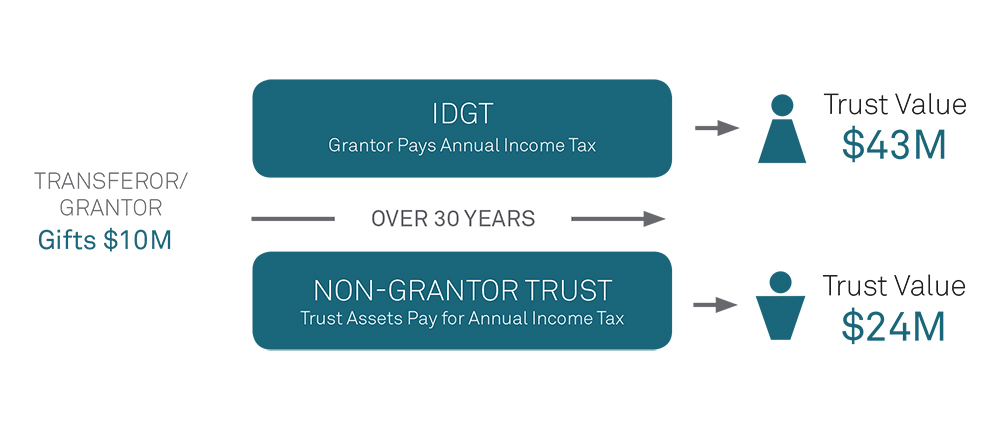

An IDGT holding $10 million in assets and earning 5% annually over a 30-year period would grow to over $43 million unencumbered by income tax liabilities. Under the same conditions, a trust needing to pay income taxes from its own assets would grow to only $24 million. The ability to transfer $43 million while using only $10 million of the allotted gift-tax exemption is a significant planning result.

Estate tax

The primary goal of a tax-efficient wealth-transfer plan is to pass on maximum value to beneficiaries, often family, in a manner that will incur the least amount of tax due during life or upon death.

IDGTs are commonly used in this context as an alternative to outright gifting. Rather than making a large gift to a child, for example, an individual could establish an IDGT for the benefit of his or her descendants and transfer assets into the trust. Though the transfer to the trust may be a gift for federal transfer-tax purposes and will reduce the available estate and gift-tax exemption by the value of the assets transferred, all future growth and appreciation will occur outside of the client's taxable estate. Ultimately, assets will be available to the beneficiaries without the imposition of estate tax.

An individual who transfers $10 million of stock in a closely held business to an IDGT and later sells that stock for $50 million will have passed an additional $16 million to his or her beneficiaries, assets that otherwise would have been paid in federal estate tax had such stock been included in the individual's federal taxable estate.1

Asset protection

Another objective of estate planning is to place assets outside of the risk of potential creditors. IDGTs can provide meaningful asset protection from the claims of future creditors and other parties, such as a beneficiary's spouse in the event of divorce. This protection applies to assets transferred to the trust as long as the transfer was not effectuated in an effort to defraud a creditor.

The "spendthrift clause" has long served as an important line of defense in providing asset protection for IDGTs. Generally, the spendthrift clause prevents the attachment or assignment of a beneficiary's interest in an irrevocable trust before the interest is distributed. As such, the spendthrift clause typically protects against creditors of the beneficiaries in cases of divorce, financial troubles or substance abuse.

Swap power

An oft-cited shortcoming of IDGT planning is that the cost basis of assets owned by the trust will not be stepped up to fair market value upon the death of the grantor, as would be the case if the same assets were a part of the grantor's estate. One of the features of an irrevocable trust that qualifies it as an IDGT is the ability of the grantor to "swap" assets held inside the trust with assets of equal value owned by the grantor.

If the grantor wishes to achieve a step-up in basis of an appreciated asset held by an IDGT upon the grantor's death (i.e., by holding the asset in the grantor's name at death and thereby having the asset included in the grantor's taxable estate), the grantor may exercise the power of substitution to swap such an asset with any asset (often cash) so long as it is of equivalent value as of the date of substitution.

Including a spouse as an eligible beneficiary

A Spousal Lifetime Access Trust (SLAT) is a version of an IDGT in which the grantor's spouse is included as a current beneficiary, usually along with the grantor's descendants. While the grantor spouse must relinquish control over property transferred to the trust, the assets are available to the beneficiary spouse in a manner that will not cause inclusion for estate tax purposes and are further available to be distributed to the beneficiary spouse should that be appropriate. SLATs can be valuable for married couples looking to minimize a future estate tax liability while still retaining a degree of access to the transferred assets. In certain circumstances, the beneficiary spouse may act as a trustee and oversee trust investments and distributions.

A common planning technique is for each spouse to create a similar SLAT for the benefit of the other, thereby utilizing a larger amount of their combined estate and gift-tax exemptions during life and allowing for greater appreciation to occur outside of their taxable estates. Care should be taken, however, to avoid the reciprocal trust doctrine.

What makes an IDGT a dynasty trust?

A dynasty trust is an IDGT designed to last for multiple generations without being subject to estate tax at the death of a beneficiary. Most states have a rule against perpetuities that requires a trust to terminate and distribute assets no later than 21 years after the death of an individual who was alive at the time the trust was created. However, several jurisdictions (Delaware, South Dakota and Nevada, for example) have abolished the rule against perpetuities and, if formed in one of those states, a dynasty trust can benefit many generations.2

Summary

IDGTs provide wealthy individuals with a powerful planning tool to aid in their effort to maximize assets for the next generation, minimize estate taxes and ensure that family assets remain protected. Including a spouse as a beneficiary will increase the flexibility of the trust and allow for distributions to the beneficiary spouse in the event that non-trust assets become insufficient. Creating the trust in a state like Delaware, which has abolished the rule against perpetuities, enables families to transfer generational wealth without the imposition of estate taxes or the requirement that the trust terminate at any point.

We recommend discussing if the benefits of a customized IDGT might be right for your specific situation with your legal, tax and investment advisors.

Footnotes

1 The federal estate tax rate is 40%. Transferring $40 million of appreciation outside of the individual's taxable estate will result in an estate tax savings of up to $16 million.

2 In certain states, the rule against perpetuities has been extended to permit a trust to last up to 1,000 years.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, Hong Kong branch is an authorized institution within the meaning of the Banking Ordinance (Cap.155 of the Laws of Hong Kong) and a registered institution (CE No. AIG365) under the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong) carrying on Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. The Bank of New York Mellon, DIFC Branch (the “Authorized Firm") is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 225 Liberty Street, New York, NY 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management's Family Office Services– International are provided through The Bank of New York Mellon, London Branch, 160 Queen Victoria Street, London, EC4V 4LA. The London Branch is registered in England and Wales with FC No. 005522 and #BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. BNY Mellon Wealth Management, Advisory Services, Inc. is registered as a portfolio manager and exempt market dealer in each province of Canada, and is registered as an investment fund manager in Ontario, Quebec, and Newfoundland & Labrador. Its principal regulator is the Ontario Securities Commission and is subject to Canadian and provincial laws. BNY Mellon, National Association is not licensed to conduct investment business by the Bermuda Monetary Authority (the “BMA") and the BMA does not accept responsibility for the accuracy or correctness of any of the statements made or advice expressed herein. BNY Mellon is not licensed to conduct investment business by the Bermuda Monetary Authority (the “BMA") and the BMA does not accept any responsibility for the accuracy or correctness of any of the statements made or advice expressed herein. Trademarks and logos belong to their respective owners.

The information in this paper is as of August 2023 and is based on sources believed to be reliable but content accuracy is not guaranteed.

©2023 The Bank of New York Mellon Corporation. All rights reserved. WM-420125-2023-08-28