Tax-loss harvesting is most effective if implemented through a custom, yet systematic process and especially important in times of market declines. When executed successfully, it becomes an important driver of investment success.

Investors often measure investment success by the return they earn on an investment. Of course, this overlooks one important concept – taxes. Paying taxes year in and year out can erode the purchasing power of a portfolio and can keep investors from meeting their long-term goals. This is why managing taxes and other costs are so important in creating long-term wealth.

At BNY Mellon Wealth Management, our Active Wealth framework deploys advice across five practice areas to help ensure clients accomplish their wealth goals. The Manage practice focuses on minimizing taxes utilizing strategies such as tax-loss harvesting, which allows an investor to turn investment losses into tax savings. While a focus on after-tax returns is important to investment success in any market, it is especially important in market downturns as tax savings can help offset some losses.

How taxes impact your portfolio

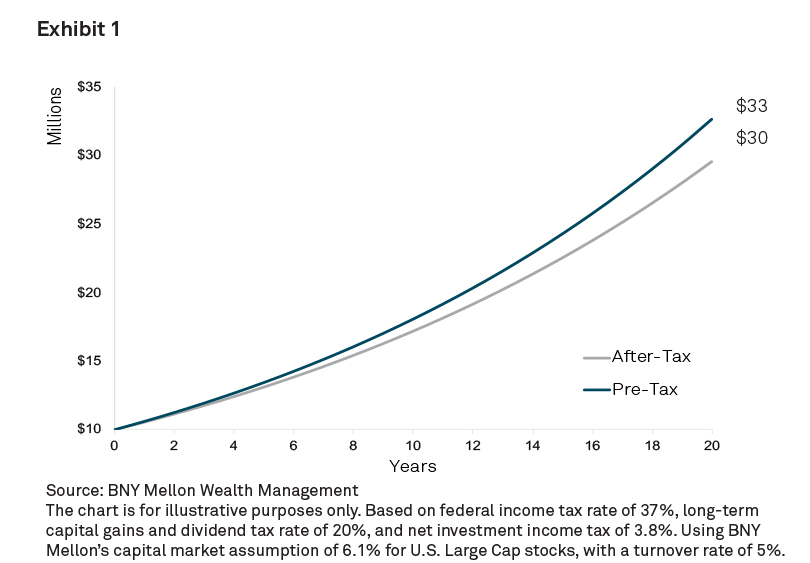

With the exception of tax-deferred accounts, such as 401(k)s and IRAs, investors have to pay taxes on their taxable investments annually. Exhibit 1 illustrates the drag taxes can have on your investments over time. Let's assume you invest $10 million in a U.S. large cap equity portfolio earning 6.1% a year for 20 years. In the first year, the portfolio would earn $610,000 in gains and income. However, you'll owe $52,479 in federal taxes in year one, making the after-tax return closer to 5.6%. Unmanaged, these taxes over time will equate to nearly 10% of the portfolio's value. That's why strategies used to minimize tax payments are important to long-term wealth accumulation.

How does tax-loss harvesting work?

"Harvesting" tax losses involves selling an investment at a loss to offset other taxable gains, thus lowering your taxes. Typically, an investment is sold at a loss with the proceeds being used to purchase a similar, but not substantially identical investment in order to maintain market exposure.

Depending on the type of the losses generated (short- or long-term), they may be used to reduce taxes in the following order:

- Offset current year's realized capital gains from investments

- Reduce ordinary income by up to $3,0001

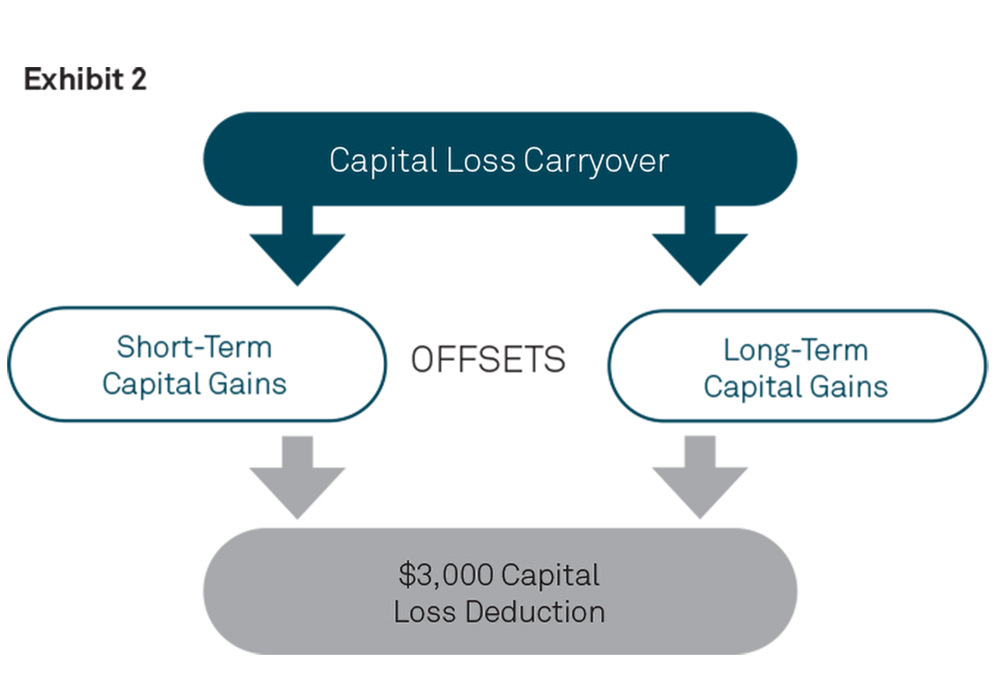

- As a capital loss carryover that may be used in future tax years. It will first be netted against future capital gains, if any, then applied towards the capital loss deduction (see Exhibit 2)

Capital gains and losses are categorized by the length of time a security is held in an investment portfolio. They are considered short term if securities were held for less than one year, and long term if the securities were held for a year or more. The difference in tax treatment is significant as short-term gains are taxed at the higher ordinary income tax (as high as 40.8%)2 while long-term gains are taxed at a special rate capped at 23.8%.2 Whether short- or long-term in nature, capital gains directly impact the after-tax return of a portfolio, emphasizing the importance of managing an investment portfolio with taxes in mind.

The rules and exceptions around tax-loss harvesting can be complex and technical. For example, the "wash sale" rule is designed to discourage people from selling securities strictly to take a tax loss. A loss is disallowed if a “substantially identical" security is repurchased within 30 days of the loss being taken. Capital losses aren't transferable upon death and if there are no capital gains, the maximum deduction against net income is capped at $3,000 for any given year.

The value of tax-loss harvesting

One of the primary advantages of tax-loss harvesting is that it can help close the gap between after-tax and pre-tax returns in any given year. By realizing a loss and reinvesting those proceeds, the cost basis is reset to a lower value. In the future, the capital gain tax bill would be higher. But, if the investment is held for more than a year, those gains will be taxed at the lower long-term capital gains rate, and the investor saves on taxes in the near term.

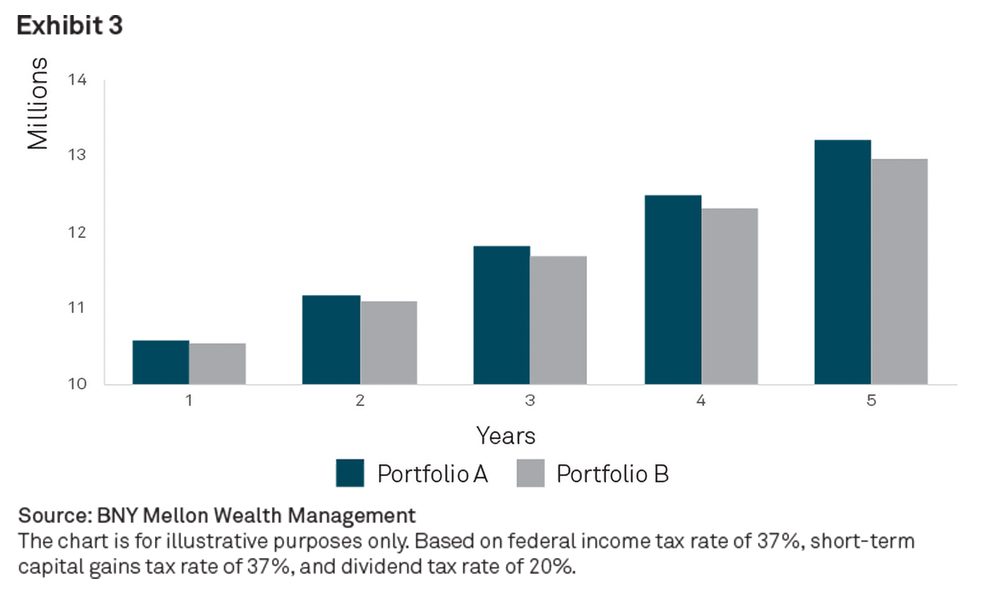

Additionally, given the concept of the time value of money, there would be a net benefit to the portfolio over time as illustrated in Exhibit 3. The chart looks at two $10 million portfolios both of which earn a return of 6.1%. Additionally, on average, the portfolio has a turnover of 25%, classified as short-term capital gains. It also assumes there is an opportunity to harvest $1,000,000 in losses due to a market correction (defined as a decline of 10%). Lastly, any taxes that need to be paid on gains will come from the portfolio, thus reducing the after-tax return.

We assume that Portfolio A, harvests $1,000,000 of unrealized losses in year one while Portfolio B does not take advantage of tax-loss harvesting. After five years, Portfolio A grows to $13.2 million or a 5.7% annualized after-tax return. Without tax-loss harvesting, Portfolio B is worth $12.9 million (5.3% annualized after-tax return), or roughly $300,000 less. Even if all holdings in Portfolio B are sold at the end of the five-year period, Portfolio A would have generated more than 0.20% of additional annual return. This illustrates why strategies used to minimize tax payments are important to long-term wealth accumulation.

Conclusion

Tax-loss harvesting can provide the following benefits:

Enhance after-tax returns by utilizing realized losses to offset gains. That reduces the need to withdraw taxes from your portfolio, thus allowing a compounding effect to drive long-term growth.

Provide the flexibility to rebalance portfolios by selling investments that have declined in value and using those losses to offset gains in an investment that has done well.

Carry losses forward to future tax years until they are used up. Can also use as an income deduction worth up to $3,000 per year, offsetting ordinary income earned.

Grow the value of your portfolio over time by reducing taxes now and in the future.

Through BNY Mellon's Active Wealth approach, harvesting losses is an active and integral component of managing investment portfolios. Tax-loss harvesting is most effective if implemented through a custom, yet systematic process and especially important in times of market declines. When executed successfully, it becomes an important driver of investment success.

Footnotes

1 $3,000 for married filing jointly taxpayers, $1,500 if for single or married filing separately taxpayers

2 Federal tax on income and gains are capped at 37% and 20%, respectively. An additional net investment income tax of 3.8% is also applied to capital gains, both short-term and long-term, for single filers with taxable income over $200,000 and married filers jointly with taxable income over $250,000. Long-term capital gains apply to assets held for more than 12 months.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, Hong Kong branch is an authorized institution within the meaning of the Banking Ordinance (Cap.155 of the Laws of Hong Kong) and a registered institution (CE No. AIG365) under the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong) carrying on Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. The services and products it provides are available only to “professional investors" as defined in the Securities and Futures ordinance of Hong Kong. The Bank of New York Mellon, DIFC Branch (the “Authorized Firm") is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management's Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E1C 5AL, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. BNY Mellon Wealth Management, Advisory Services, Inc. is registered as a portfolio manager and exempt market dealer in each province of Canada, and is registered as an investment fund manager in Ontario, Quebec, and New Foundland & Labrador. Its principal regulator is the Ontario Securities Commission and is subject to Canadian and provincial laws. BNY Mellon, National Association is not licensed to conduct investment business by the Bermuda Monetary Authority (the “BMA") and the BMA does not accept responsibility for the accuracy or correctness of any of the statements made or advice expressed herein. BNY Mellon is not licensed to conduct investment business by the Bermuda Monetary Authority (the “BMA") and the BMA does not accept any responsibility for the accuracy or correctness of any of the statements made or advice expressed herein. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. ©2020 The Bank of New York Mellon Corporation. All rights reserved.