This article discusses the two cash management approaches our Global Family Office group is seeing in use among top family offices.

With the most aggressive tightening cycle in over 40 years creating attractive short-term yields unseen for decades, one of the most frequent questions we hear from single family offices at BNY Mellon Wealth Management is: “How are my peers thinking about liquidity management?”

While every family office investment program is different, our Global Family Office group sees common approaches to supporting cash needs efficiently in a timely manner while maximizing yield. The first approach is to accept what the market provides and spend as little time as possible thinking about managing liquidity. The second approach involves organizing cash into different buckets based on expected use of that cash to maximize after-tax yield.

Framework #1: Keep It Simple

Prior to the start of the 2022 interest rate hiking campaign, when short-term interest rates were ~0%, the only way to capture a meaningful yield on cash was to increase credit and/or duration risk. While some offices were comfortable with this, others opted to keep it simple and invest in some combination of money market funds and short-term Treasuries, and/or maintain cash reserves in bank deposit programs.

The rationale we hear from family offices that have decided to keep it simple is that they believe the opportunity cost to not keeping it simple is too high: time spent on managing their liquidity program is time they do not spend on investments with higher alpha-potential where they may have a competitive edge (e.g., their operating business or direct investing). Given this trade-off, they prefer to keep it simple and spend their time elsewhere.

Framework #2: Liquidity Bucketing

On the other hand, there are many family offices that believe it is worth the time to create a custom bucketing framework to maximize liquidity and after-tax yield on their cash while considering planned (and unplanned) spending needs. Additionally, liquidity bucketing provides the family office with flexibility so that they are not forced to redeem investments at inopportune times, such as during market dislocations. The framework is also transparent: with the reasoning for each bucket – and the holdings within it – clearly delineated.

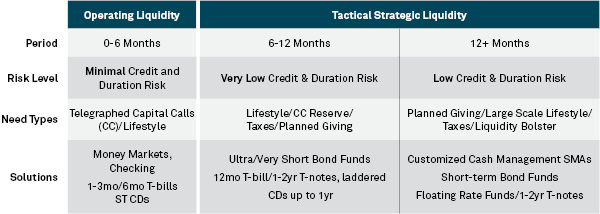

For clients who subscribe to the liquidity bucketing approach, the general framework is: 1) match the duration of the asset (e.g., cash) with the duration of the liability (e.g., expected cash usage) and 2) select investments within each bucket that incrementally, and prudently, increase the credit and/or duration risk to maximize the after-tax yield. While true cash should be used to fund day-to-day liabilities, as cash buckets extend into the future the family office can choose to allocate to ultrashort and short-term bond holdings or other solutions (see Exhibit 1).

Exhibit 1: Example of Cash & Near Cash Bucketing

Source: BNY Mellon Wealth Management, 2023.

Customization and Control

Amid the shifting interest rate environment, we have observed an increased adoption of the liquidity bucketing approach. The reason is twofold:

1. More customization based on discrete cash flow and liquidity needs

2. More control and transparency via separately managed accounts (SMAs)

We have also seen higher demand for customized SMAs. These separately managed accounts provide the investor with increased control and transparency over their investments (e.g., they are able to sell specific securities to meet liquidity goals versus having to partially redeem a mutual fund). This increased control might lead to tax advantages, depending on the gain/loss disposition of the securities available within the SMA. Additionally, a separately managed account can inoculate an investor against “flow risk,” whereby investor redemptions from a fund could adversely affect other investors since a portfolio manager might need to sell securities at inopportune times to meet liquidation requests.

A potential downside of incorporating a custom SMA into a liquidity management program is that it may introduce additional operational and reporting complexity. For example, an investor might receive a bulky statement with many line items, making consolidated reporting and risk monitoring cumbersome. Our Global Family Office group can help clients fully mitigate these operational issues and simplify the process.

Considering Your Liquidity Management Options

Liquidity management has never been more important than it is today. As a leader in cash management strategies, separately managed accounts and tailored lending solutions, we welcome the opportunity to discuss ways to potentially enhance your liquidity management program.