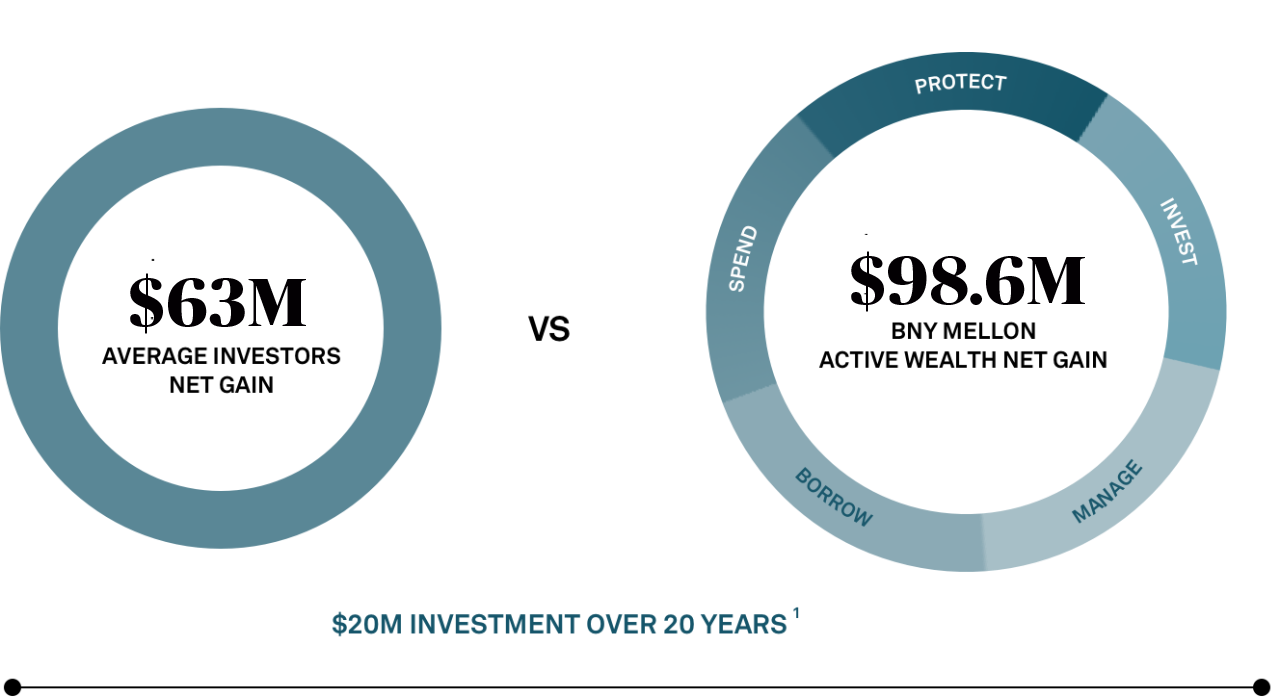

For 240 years BNY Wealth has helped successful individuals and families build, manage and sustain their wealth across generations and market cycles. Our Active Wealth approach is grounded in a deep understanding of our clients. For each client, we craft a customized approach around five essential wealth practices: invest, borrow, spend, manage and protect that empowers our clients to confidently navigate the unpredictable and unexpected.

The professionals in our Newport Beach office offer more than 200 years of combined industry experience. The office provides a broad range of wealth management services, with a focus on business owner transitions, family law, and inherited wealth. In fact, over 70% of the office’s top 100 clients are former business owners who turned to us for transition planning. The team holds numerous advanced financial planning degrees, with specializations in tax, estate, investment, divorce and business transition/exit planning.