Footnote:

1 Committee for a Responsible Federal Budget. Includes monetary and fiscal stimulus. Last updated December 9, 2022.

To say that 2022 was painful for fixed income investments is a supreme understatement. Returns on the Bloomberg Aggregate Bond Index ended down 13%, the worst performance since its inception in 1977.

The back story is well-known at this point. U.S. inflation went from 1.8% pre-Covid to a 40-year high of 9.1% in 2022, after nearly $11 trillion of pandemic stimulus was pumped into markets and consumer wallets.1 The inflation shock prompted the fastest rate-hiking cycle by the Federal Reserve since the 1980s, with the federal funds rate going from 0%-0.25% in January to 4.25%-4.5% in December.

But as bad as 2022 was, it left yields at their highest levels in almost 10 years. Bonds are finally able to behave like bonds again, by providing enough income-producing yield to act as ballast against equity volatility in diversified investment portfolios.

We’re also starting 2023 with a weakening economy and signs that inflation is moderating. While policy uncertainty will still be a source of volatility, we are closer to the end of the Fed’s tightening cycle, which should lead to a more stable interest rate environment. Additionally, corporates and municipalities are in good fiscal shape and should be more resilient in an economic downturn.

In short, bonds are back. Fixed income has the potential to provide positive returns in 2023, making it an opportune time to recommend an increase in fixed income allocations.

With the days of near-zero rates and easy monetary policy behind us, fixed income yields should provide decent income for several years. Furthermore, total returns should be particularly attractive in the first half of 2023.

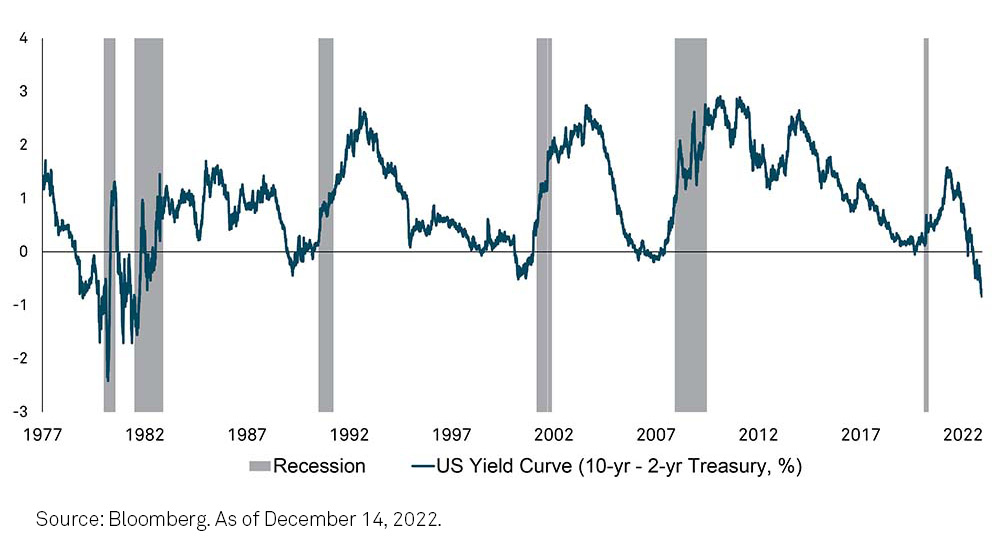

The 10-year and longer-dated Treasury bonds have the potential to go up in price and down in yield in coming months, as the market collects increasing evidence that inflation is trending downward, and economic growth is slowing. That would deepen an already inverted Treasury yield curve, where the 2-year yield is higher than the 10-year.

Although the Fed’s rate hikes sent yields up on all Treasuries last year, the most rate-sensitive 2-year increased 350 basis points (or 3.5%) to finish 2022 at 4.43%. That compares with a 250 basis point rise in the 10-year yield, which ended 2022 at 3.87%. We think the yield difference between 2- and 10-year notes could deepen from 56 basis points at the end of last year to 100 basis points in the coming months.

Yield curve inversions have preceded the last six recessions and we expect this time will be no different. We place a 70% chance of a mild recession occurring later in 2023.

The Fed signaled in December that it expects the federal funds rate to peak at around 5% or a little higher. We believe they will get there by mid-year, but we think that market hopes for a Fed pivot to lower rates by year-end are premature. Even if inflation continues to subside and we have a mild recession, the Fed is likely to hold rates high for many quarters to come. The last thing the Fed wants to do is repeat the mistake it made during its battle against inflation in the 1970s, when it cut rates too early, and inflation reignited.

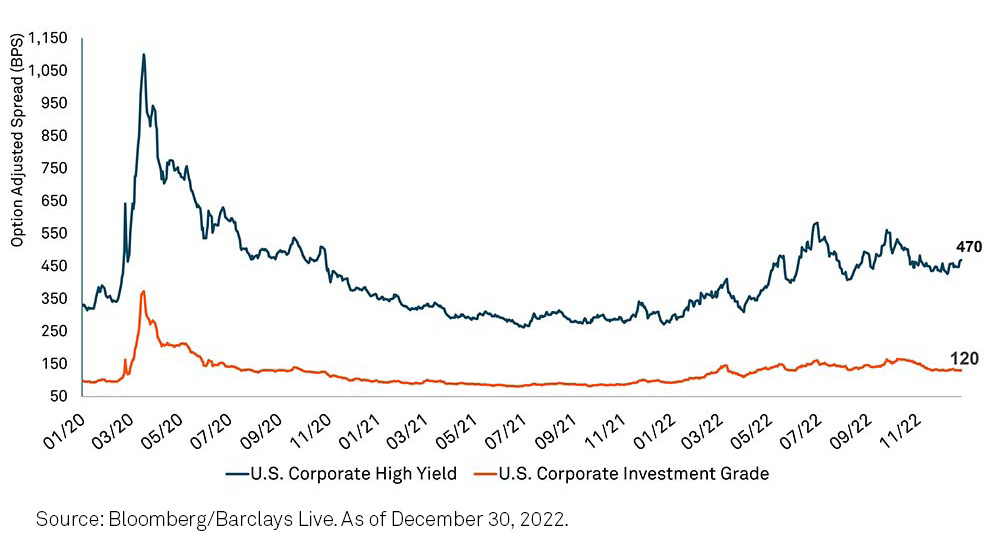

Widening credit spreads (the extra yield corporate bonds pay over “risk free” Treasuries to reflect credit risk) and rising rates weighed on corporate bonds for most of last year, until the final weeks of 2022 when spreads rallied on expectations that an economic downturn will be mild.

After starting 2022 at 93 basis points, investment grade credit spreads widened out to 165 basis points, before rallying to 130 basis points by year-end. Meanwhile, high yield spreads started out at 278 basis points, widened to 583 basis points by September and recovered to finish 2022 around 470 basis points.

We continue to like both investment grade and high yield (non-investment grade) bonds, given their attractive yields of close to 5% and 9%, respectively. After years of using low borrowing costs to refinance debt and extend maturities, corporate balance sheets are in good shape, and should be more resilient going into a recession this year than they were in 2008. We are not looking for a dramatic increase in default rates.

We are constructive on high yield and rely on our fundamental analysis to detect quality companies more able to weather a recession and offer compelling bond yields. We still favor high yield floating rate notes over high yield fixed because the former tends to be slightly higher in quality and will likely continue to outperform. That said, there may be attractive income opportunities among fixed rate high yield bonds that were oversold last year.

While credit spreads may widen as the economy slows, we are unlikely to experience as much widening as we saw in past recessions. Corporate bonds are expected to offer investors positive total returns, with higher coupons and potential price appreciation arising from an eventual tightening of spreads once the market prices in an economic recovery.

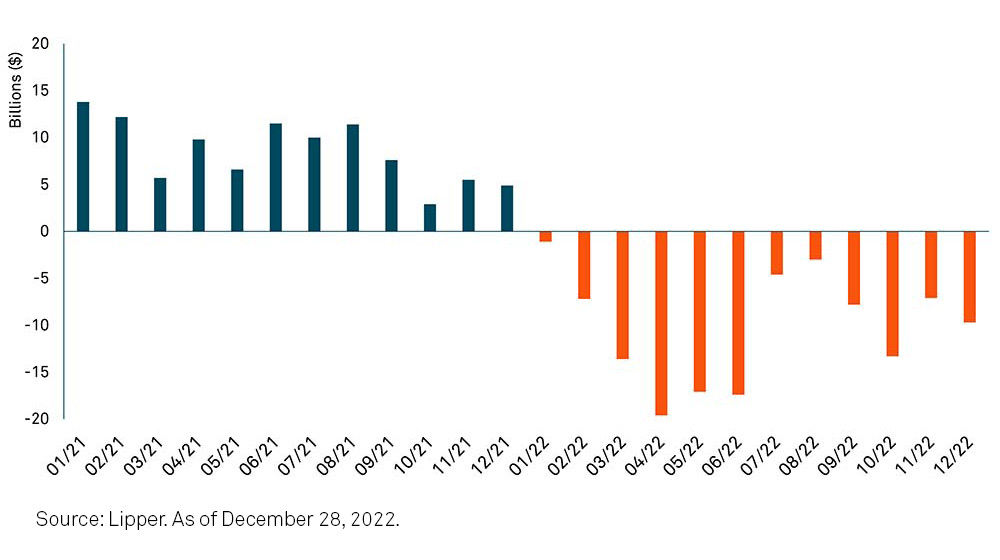

Our outlook for the municipal bond market is also positive. Municipals suffered from mass retail investor capitulation as well as tax-loss selling in 2022, with a record $122 billion of withdrawals wiping out 2021’s $102 billion of record inflows. But demand rebounded in the fourth quarter of 2022, as investors swept in to take advantage of huge price dislocations. The total return of the Bloomberg Municipal Bond index was -8.5% for 2022, better than U.S. credit and Treasuries.

A more stable interest rate environment should also increase demand for municipal bonds this year. Although investors seized most of the opportunities to capture attractive yields in AAA municipal bonds in late 2022, there are securities rated single-A and lower that offer attractive after-tax income for investors in high tax brackets. For example, investors willing to take on slightly more risk while staying in investment grade municipal bonds can receive tax equivalent yields of 5-6% on 10-year munis A-rated and below. The after-tax benefits are even greater for individuals in high tax states like New York and California.

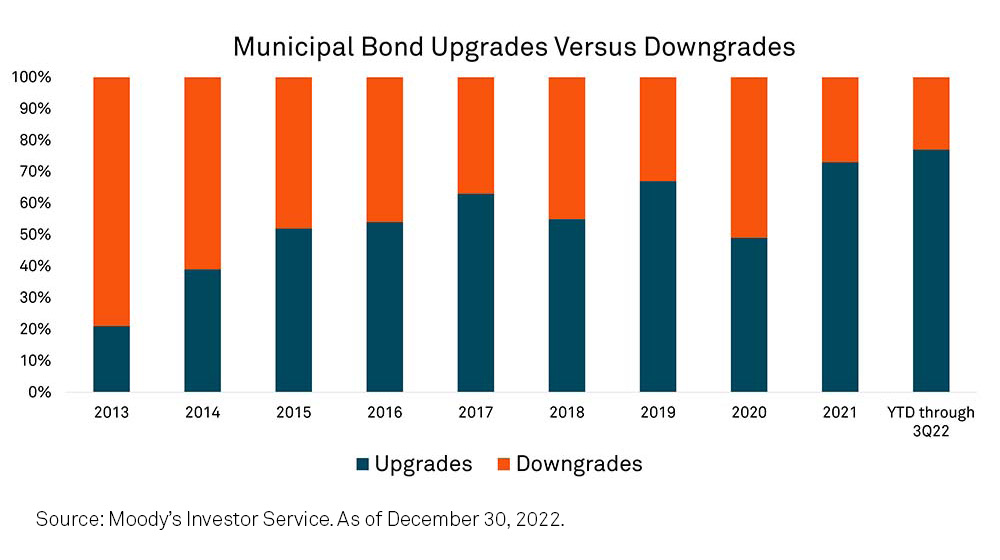

It’s important to note that it was mostly panic selling and tax-loss harvesting rather than fear of rising defaults that caused the muni bond sell off in the first three quarters of last year. Credit quality is in sound shape overall. Most states and localities ended their 2022 fiscal year in the black and many had record surpluses. The combination of record tax receipts from a strong 2021 and substantial federal stimulus during the pandemic swelled general fund balances.

Although default rates are at record lows in the muni market, a recession could cause budget deterioration and deficits for municipal issuers that have traditionally done a poor job of controlling spending and keeping up with retirement and healthcare obligations. That said, it usually takes at least a year after a recession before municipalities feel the worst impact. We are not overly concerned about municipal credit in 2023 but remain vigilant as we look a few years out.

In all, it’s hard not to be optimistic about bonds in 2023, given the higher starting yields and as we approach the tail-end of the rate-hiking cycle. We think it’s time to increase fixed income allocations, by adding to intermediate- and long-term bonds to capture more yield and to position for a rally in Treasuries.

Outperformance in fixed income markets comes from managing interest rate risk, knowing the trends of each market sector, undertaking fundamental analysis of each issuer’s credit quality, and finding the individual bonds that are trading wider than comparable securities. We will continue to utilize our robust credit analysis and active management to uncover the best opportunities across fixed income in 2023.

Footnote:

1 Committee for a Responsible Federal Budget. Includes monetary and fiscal stimulus. Last updated December 9, 2022.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

©2023 The Bank of New York Mellon Corporation. All rights reserved.

WI-336773-2023-01-12