A recession is likely in 2023, but investors should look beyond it and position for recovery in a new investing environment shaped by higher rates, lingering inflation, and hawkish central banks.

KEY TAKEAWAYS

1. A mild global recession is likely, with a recovery toward the end of 2023.

2. Inflation moderates but remains elevated above the post-global financial crisis level of near 2%.

3. The Federal Reserve (Fed) is likely to hike and hold due to elevated inflation in the services sector.

4. Bonds are back as higher yields can now provide attractive income and a ballast in portfolios.

5. A new equity regime emerges as the era of ultra-low rates and enhanced liquidity recedes and investors face a new world of higher borrowing costs and lingering inflation.

What Will 2023 Hold for Investors?

2022 will soon be behind us, and not a minute too soon. It has been a year of unprecedented volatility. Inflation at a 40-year high and the fastest Fed interest rate hiking cycle since 1980 resulted in negative returns for most asset classes.

Will 2023 be any better? We think the answer is yes, eventually. Inflation appears to have peaked, which will eventually enable central banks to slow the pace of rate hikes and ultimately shift into a holding pattern. However, risks have now shifted to the lagged impact of aggressive monetary policy tightening on economic growth and earnings.

We see a 70% probability of a global recession, but in our view it will likely be mild and short-lived. However, the market has yet to price this in, which is why we expect volatility to continue in the first half of 2023. History tells us that markets can rebound before a recovery in the real economy. These rallies are very hard to pinpoint and can happen quickly, making it critically important to stay invested. It’s likely to be a challenging investment landscape, but one that will undoubtedly present opportunities.

Exhibit 1: Tightening Cycle Journey

Recession or No Recession?

The U.S. economy has remained resilient to date, despite high inflation and the rapid pace of rate hikes totaling 4.25% over 10 months. Aided by a tight labor market, increasing wages and more than $1 trillion of savings leftover from the pandemic, consumer spending continued to drive U.S. growth through the third quarter. November’s consumer price index (CPI) helped to confirm that inflation has peaked, with both year-over-year headline and core readings slowing for the second consecutive month. Yet, even as inflation is easing and the Fed begins to slow its pace of tightening, we are concerned that stickier inflation drivers, namely labor and shelter costs, will keep monetary policy tighter for longer and push the economy into a mild recession.

Exhibit 2: Inflation Peaking, but Still at Multi-Decade High

In Europe, energy shortages caused by Russia’s invasion of Ukraine have already taken a toll on growth in the Eurozone and the U.K., and will keep upward pressure on inflation as long as the war continues. Despite inflation remaining at 10%, the Eurozone’s growth has surprised to the upside thus far, but the region will likely fall into recession in the first quarter. China’s growth is expected to improve and could get a boost from the end of its zero-Covid policy, although there is still uncertainty surrounding the pace of its reopening.

Exhibit 3: Our Global Growth and Inflation Estimates

The Fed’s Battle Isn’t Over

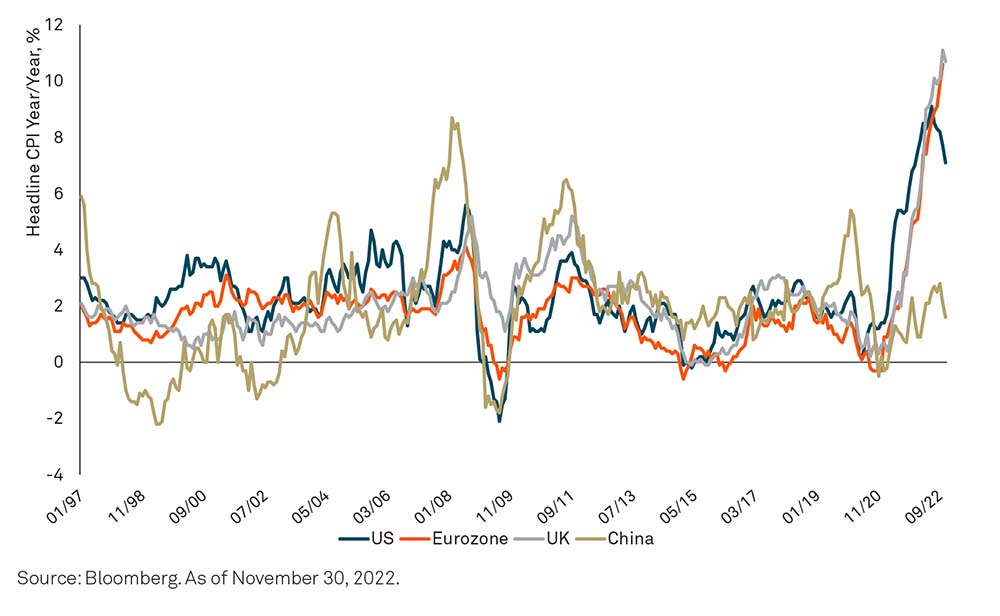

The Fed increased interest rates another half percent to a target rate of 4.25% to 4.50% in December, after headline inflation slowed in October and November. With the central bank hiking at a slower pace, the focus is turning to when the rate cycle may come to an end.

In prior tightening cycles, the cycle ended when the federal funds rate was greater than the inflation rate. With the current inflation rate nearly three percentage points above the fed funds rate, the Fed likely has more work to do. We expect the fed funds rate to peak around 5% by the middle of next year. While market consensus has priced in interest rate cuts by the third quarter of 2023, we think the Fed is likely to hold rates steady after its final hike.

Exhibit 4: Fed Has More Work to Do

At the center of the Fed’s battle against inflation is the U.S.’s chronic shortage of labor. Better-than-expected gains in both wages and employment in November underscored the labor market’s resiliency. While goods prices have declined, and the housing market’s sharp downturn should soon be reflected in inflation through lower shelter costs, a strong labor market continues to add to inflationary pressures.

Inflation should continue to decelerate in 2023, but it’s unlikely to reach the Fed’s target of 2% until at least late 2024. BNY Mellon Wealth Management’s forecast is for the headline consumer price index to fall to 4%-5% by the end of 2023.

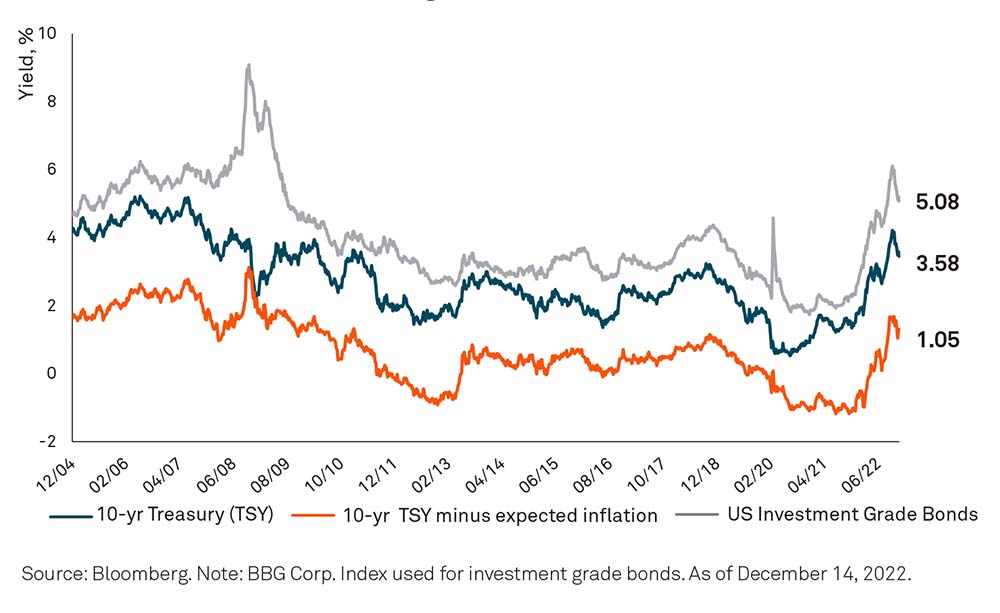

Fixed Income More Attractive

Bonds suffered their worst performance in 40 years in 2022, with the Bloomberg Aggregate Bond Index down about 11% after partially recovering from even steeper declines.1 But the inherent upside of a decline in fixed income prices is that bonds now offer their most attractive yields in more than 10 years.

Exhibit 5: Bond Yields at Their Highest Levels in a Decade

For investors, it means that TINA (There is No Alternative to Equities) is over, with the focus now on generating income through higher yields. At a 3.6% yield, 10-year Treasuries offer greater income than the S&P 500’s 1.8% dividend yield. With these improved yields, we are upbeat about the potential for more attractive total returns moving forward and for bonds to revert to their traditional role as a ballast in portfolios.

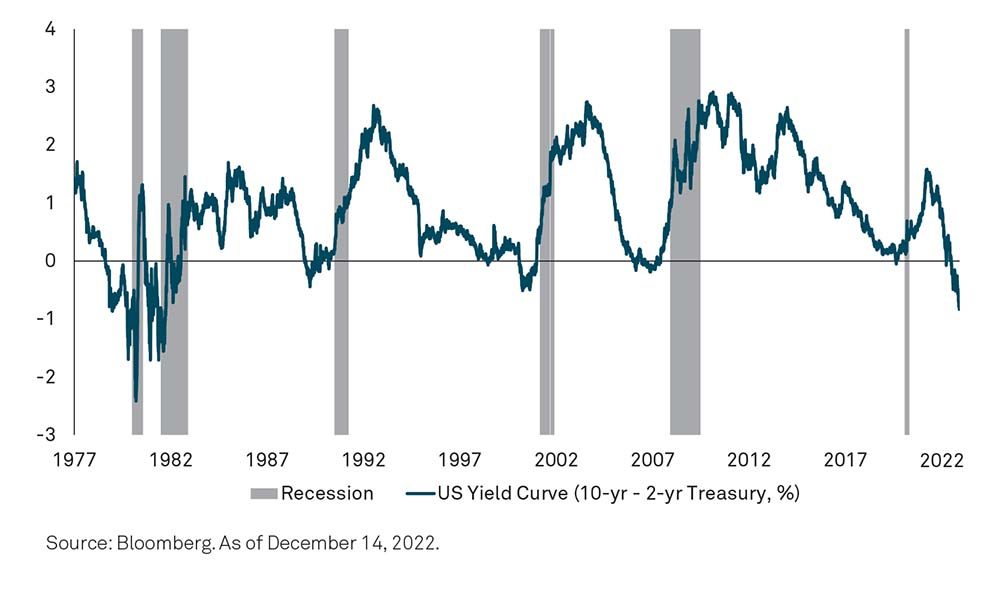

The Treasury market has endured extreme volatility in the past year. Historically, a yield curve inversion – when short-term yields are higher than long-term yields – has been a reliable predictor of recessions. As of mid-December, the yield curve was the most inverted it has been since the early 1980s.

Looking ahead, we expect the yield curve to invert further in the first quarter of 2023 as markets price in peak rates and weaker economic data appears. The Treasury yield curve should normalize as markets price in an eventual economic recovery in the latter part of the year. We forecast a 10-year Treasury note yield in the 3.75%-4.25% range by the end of 2023. That’s close to where it is today, but investors should be prepared for significant volatility in the interim.

Exhibit 6: Inverted Yield Curves Signal Recessions

More Pain Before Gain in Equities

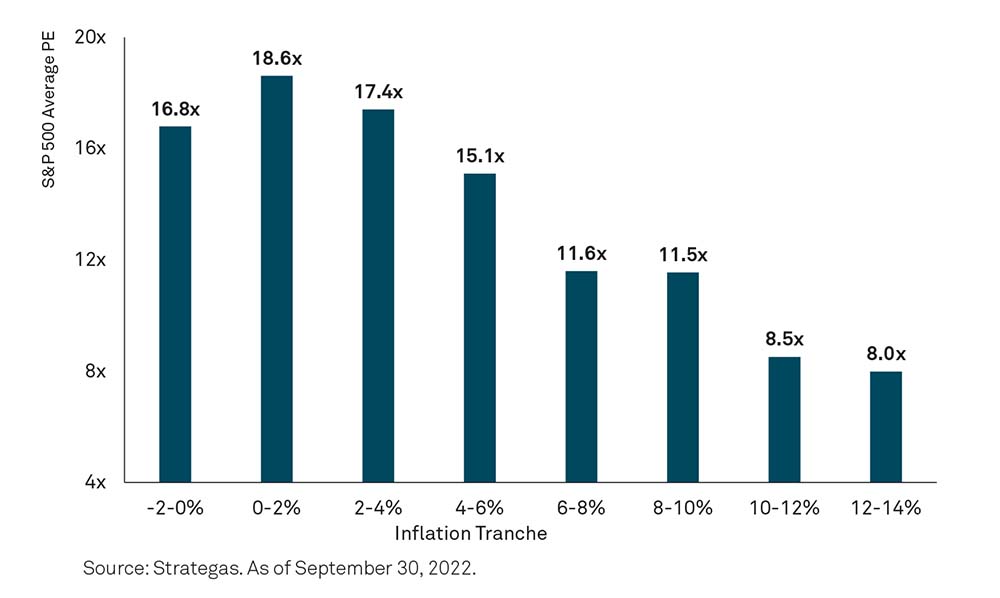

2022 was a volatile year for equities with an environment of higher inflation and higher interest rates putting downward pressure on valuations.

Equity price-to-earnings (P/E) multiples weaken with higher inflation, particularly when the rate is above 6%, as we’ve seen this year. The 12-month forward P/E fell from 21.5x in January, which is historically high, to the 2022 low of 15x in October.

Exhibit 7: Impact of Inflation on Multiples

Looking ahead, we don’t expect stocks to bottom until the market prices in a recession and Wall Street’s consensus 2023 earnings per share (EPS) estimate falls further. At $232, the consensus EPS estimate is considerably higher than our $205-$215 estimate, which reflects the weakening economy.

Our 2023 year-end range for the S&P 500 is wide at 3,800 – 4,500, reflecting the considerable macro-uncertainty ahead. Based on the midpoint of this range, that’s a gain of about 9% from today’s S&P 500 level of about 3,800. Markets are discounting mechanisms and will begin to price in an earnings recovery before we start to see improvements in the economy itself. Assuming an economic recovery by the end of 2023, we anticipate earnings will move higher in 2024 and have estimated an earnings of $240-$250. Although it is unlikely the market will have a V-shaped recovery given the prospect of higher rates and inflation continuing in the coming years, we do expect returns to be positive in 2023.

Positioning for Potential Recession and Recovery

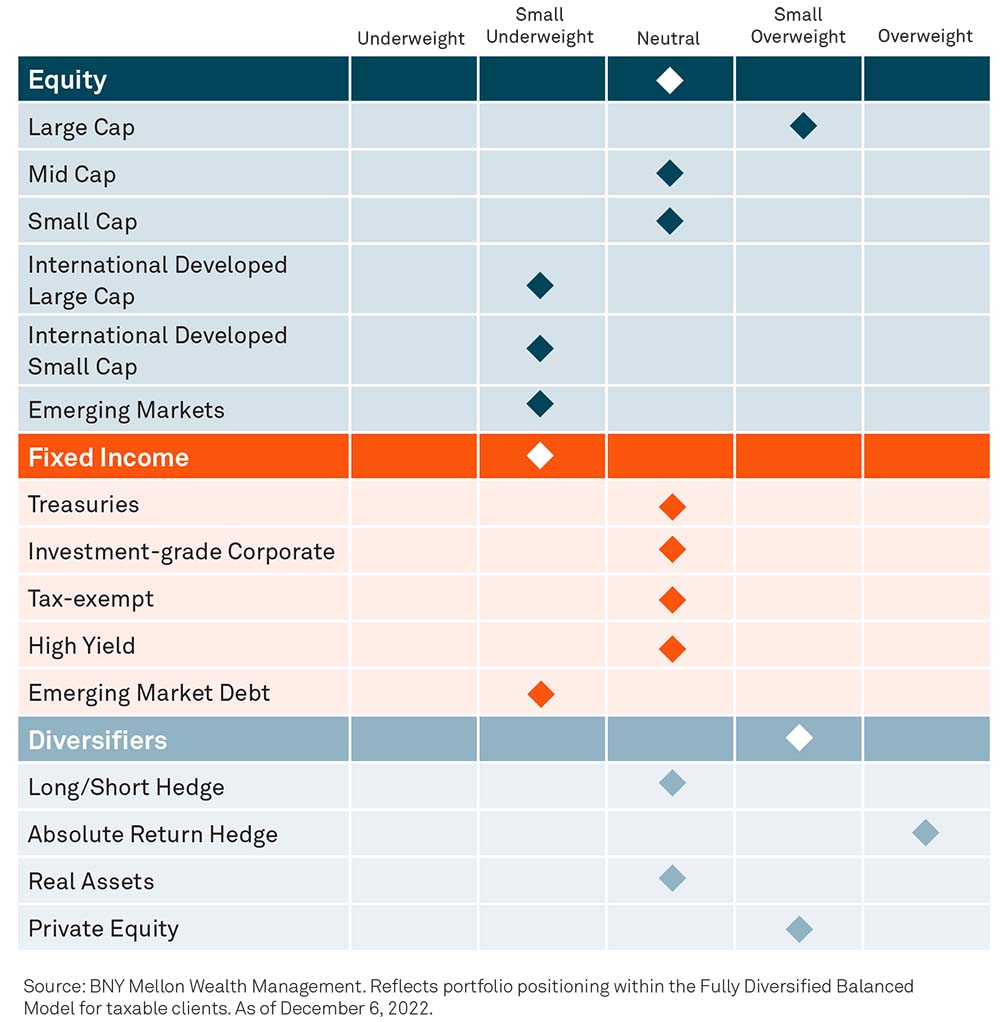

While 2022 was a challenging year, we believe some of our asset allocation shifts over the last year have allowed portfolios to adapt to an environment of higher rates, lingering inflationary pressures and a hawkish Fed. These adjustments included a neutral equity posture, an underweight to non-U.S. equities, an early underweight to fixed income, increased exposure to alternatives and building more liquidity, which will allow us to take advantage of forthcoming market dislocations.

With a 70% chance of a recession in 2023, our cautious positioning with a neutral weighting in equities, a small underweight in fixed income and a small overweight to less correlated diversifiers remains prudent. Until we see more evidence of earnings weakness and an economic slowdown, we will remain cautious.

For the first time in more than a decade, fixed income will provide more yield than equities and play its traditional role as a diversifier to offset stock market volatility. We have shifted positioning within our fixed income allocation to capture yield, increase quality and modestly extend duration ahead of a recession. We continue to favor credit, especially investment grade corporate bonds given their attractive yields and improving corporate balance sheets. We are a bit more cautious on high yield bonds and may reduce our neutral weighting should credit ratings and profitability begin to deteriorate. While off their highs, municipal bonds still offer attractive after-tax yields, especially within intermediate and long maturities.

Our equity allocation favors the U.S. relative to other markets, with a preference for large cap stocks. There has been a regime change within equities, with companies that outperformed in the era of ultra-low rates and ample liquidity expected to underperform in an environment of higher borrowing costs and lingering inflation. High-quality companies that generate strong cash flows and profits, as well as those that offer sustained dividend growth, should provide better value.

Although we maintain a small underweight to non-U.S. equities, there is the potential to increase exposure to beaten down areas of the market in the new year, especially if the U.S. dollar’s strength softens. This could occur as the U.S. economy slows and interest rate differentials begin to converge as the Fed nears the end of its tightening cycle. We are also watching for opportunities in small cap stocks, which tend to outperform large caps when bear markets end.

Importantly, alternative investments, or diversifiers, should continue to help enhance risk-adjusted returns and deliver diversification benefits via their low correlation to public markets, as we saw in 2022.

Within alternatives, non-traditional strategies can take advantage of dislocations in markets and the economy while providing less correlated sources of return to portfolios. Real assets, such as infrastructure and private real estate, can benefit from rising prices and should continue to provide a good inflation hedge. Strategies such as global macro, distressed investing and opportunistic real estate are positioned to take advantage of dislocations that may occur globally as central banks continue to reduce liquidity and increase the cost of capital.

We also believe recessionary and post-recessionary periods are opportune times to allocate to private equity as skilled managers can purchase companies at lower prices and utilize an active, hands-on approach to driving growth and creating value.

Exhibit 8: Asset Class Positioning

2023 and Beyond

Investors should also remember the importance of maintaining a long-term perspective. Often after a challenging year of negative returns, markets gravitate toward their historical averages. In fact, our 2023 10-Year Capital Market Assumptions forecast higher returns across most asset classes compared to last year’s projections.

Exhibit 9: 2023 vs. 2022 10-Year Capital Market Return Assumptions

While we expect a better return environment in 2023, volatility is likely to persist until we gain more clarity on the lagged impact of the Fed’s tightening cycle on the real economy. However, any downturn from here will likely present investors with good entry points as markets tend to move higher over time.

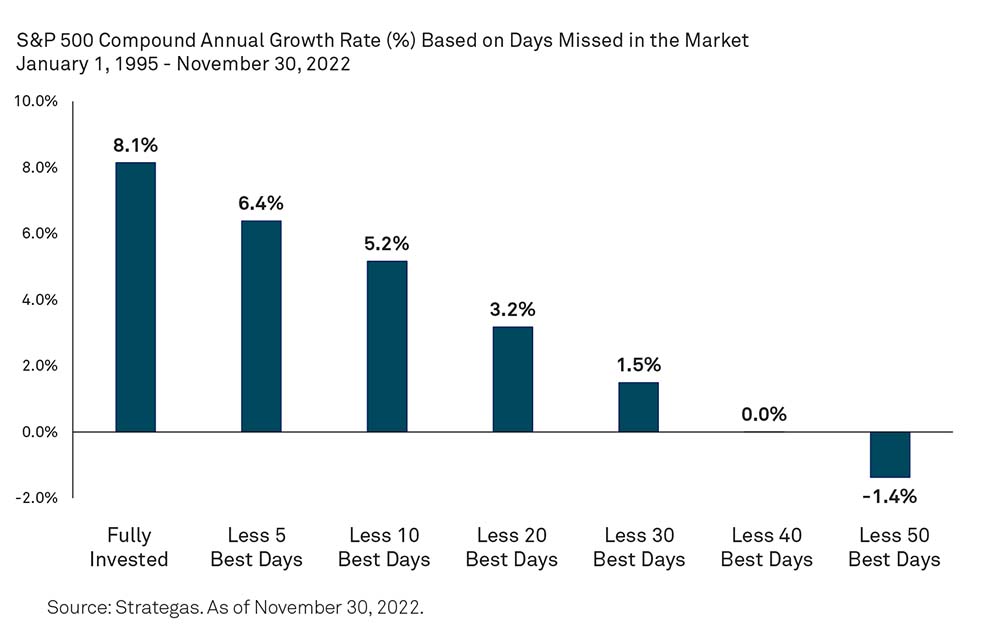

With that said, timing the bottom of the market is extremely challenging. We encourage clients to stay invested, as the best days in the markets often quickly follow the worst – and we have seen this play out this year during several bear market rallies. Most importantly, investors should remember that markets are forward looking and anticipate changes in the real economy, roughly 6-12 months ahead of when they appear in economic data. While the market is unlikely to bottom before the recession starts, it can rally before that data turn uniformly positive.

Exhibit 10: Dangers of Market Timing

There will be an inflection point where markets see through to the recovery. This transition to an environment of higher rates, higher inflation and tighter monetary policy has been fraught with volatility. We believe the combination of timely asset allocation shifts, broad diversification, and the discipline to stay invested over the long term will be critically important.

We will keep you informed of key developments and their impact on investment strategy and, as always, help you uncover opportunities that can help build and preserve your wealth.

Click here to download the PDF

Footnotes

1 As of December 14, 2022.

This material is provided for educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice and may not be used as such. Effort has been made to assure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. We recommend all individuals consult with their lawyer or tax professional, or their investment or financial advisor for professional assurance that this material, and the interpretation of it, is accurate and appropriate for their unique situation. The comments in this paper reflect the author's views and may not reflect the opinion or views of BNY Mellon. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. Trademarks and logos belong to their respective owners.

The information in this paper is current as of December 2022. It is based on sources believed to be reliable, but its accuracy is not guaranteed.

©2022 The Bank of New York Mellon Corporation. All rights reserved. WM-330699-2022-12-16