The 2023 edition of our 10-Year Capital Market Assumptions (CMAs) offers our projections for asset class returns, volatilities and correlations over the next decade. This yearly exercise helps in shaping the design of our investors’ long-term portfolios.

Download the full Capital Market Assumptions Report here.

Executive Summary

Slowing global economic growth and the persistence of elevated inflation have weighed heavily on market returns in 2022. With limited evidence of victory in their battle against inflation, monetary policymakers have remained resolute in their hawkish view and continue with tightening monetary policy. There have been few “safe-haven” assets in 2022, regardless of asset class, geography, market cap, style, credit quality and/or duration.

However, looking forward, the increased market volatility and asset repricing during 2022 have driven notable changes to our 2023 forecasts relative to our forecasts just a year ago.

Key Takeaways: Higher Expected Returns

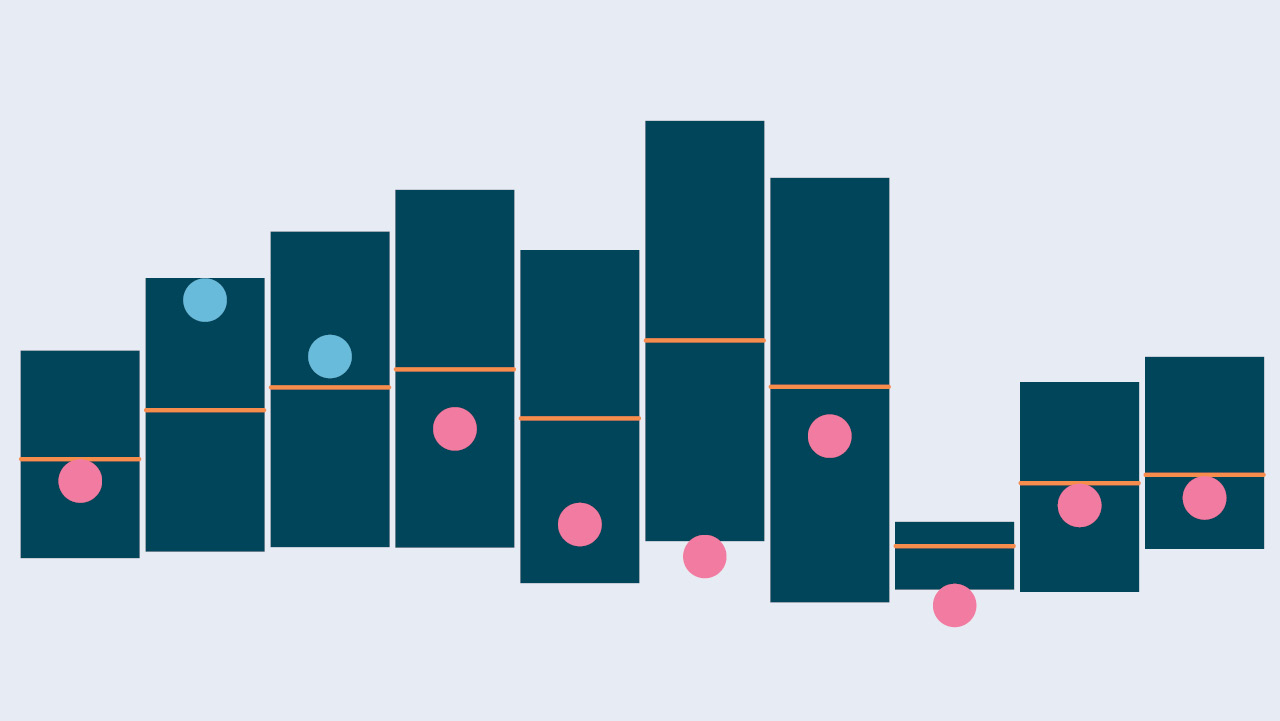

- Our 2023 10-Year CMAs forecast higher expected returns across most asset classes when compared to 2022 assumptions (see table below).

- Equity market expected returns have increased due to slightly higher long-term growth rates and upward valuation adjustments (most notably in emerging markets).

- Fixed income asset class expected returns have reverted to levels not seen in many years, significantly higher when compared to 2022 given the dramatic increase in global bond yields.

- Alternative asset class expected returns are generally higher and in line with publicly traded markets on a risk-adjusted basis plus incremental return for alpha and illiquidity.

Snapshot of 2023 vs. 2022 10-year Capital Market Return Assumptions

Themes to Watch

Looking beyond the next 10 years, we also explore the impact of themes that may shape market expectations and impact these forecasts over a longer timeframe.

- Geopolitical challenges — Continued geopolitical tensions may result in further deglobalization and reshoring, impacting variable costs, corporate margins and investor returns.

- Environment, Social and Governance — We expect ESG and responsible investing to increasingly influence investor allocation decisions and thereby have a potentially larger impact on financial markets for years to come.

Macroeconomic Backdrop

When building capital market assumptions, we start with projections of inflation, real GDP growth, short-term interest rates and currency rates. Inflation and real GDP growth are key drivers of our expected earnings growth for equity. Projections of inflation and real cash rates are extremely influential in projecting fixed income yields and returns.

The economic projections underpinning our asset class return assumptions are based on three economic scenarios outlined in BNY Mellon Investment Management’s 2022 Q4 Vantage Point. These scenarios take into account pressing issues facing the world economy including the ongoing energy crisis, triggered by Russia’s invasion of Ukraine; persistent core inflation driven by tight labor markets and high wage inflation and, China’s zero-Covid policy and property deflation.

We develop return expectations under each of these scenarios, then probability weight the returns to determine our overall “expected” return. This approach allows us to not only analyze portfolios based on the expected case, but also to shock the portfolio under the various scenarios. We encourage you to read the latest Vantage Point to learn more about our economic projections.

Importance of Capital Market Assumptions

Capital market assumptions are the initial building block for the development of an investor’s strategic asset allocation (SAA). However, forecasting is an inherently error-prone endeavor, because financial market performance exhibits a high degree of uncertainty.

When designing a policy portfolio to weather the highs and lows of the coming market cycle, we propose investors consider a “robust” portfolio, rather than an “optimal” one. To learn more, please contact your BNY Mellon representative.

Download the full Capital Market Assumptions here.

Download a PDF of this Capital Market Assumptions Executive Summary here.

For Financial Professionals and Institutional Investors Only.

BNY Mellon Investor Solutions may refer clients to certain of its affiliated offering expertise, products and services which may be of interest to the client. Use of an affiliate after such a referral remains the sole decision of the client. BNY Mellon Investor Solutions, LLC is an investment adviser registered as such with the U.S. Securities and Exchange Commission (“SEC”) pursuant to the Investment Advisers Act of 1940, as amended. BNY Mellon Investor Solutions, LLC is a subsidiary of The Bank of New York Mellon Corporation. BNY Mellon Investor Solutions, LLC business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All information contained herein is proprietary and is protected under copyright law. BNY Mellon Investor Solutions, LLC and BNY Mellon Securities Corporation are subsidiaries of The Bank of New York Mellon Corporation.

For Financial Professionals and Institutional Investors Only.

This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Any statements and opinions expressed are as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY Mellon or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY Mellon and its affiliates are not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. To the extent that these materials contain statements about future performance, such statements are forward looking and are subject to a number of risks and uncertainties. Information and opinions presented have been obtained or derived from sources which BNY Mellon believed to be reliable, but BNY Mellon makes no representation to its accuracy and completeness. BNY Mellon accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: For Institutional, Professional, Qualified Investors and Qualified Clients. For General Public Distribution in the U.S. Only. • United States: by BNY Mellon Securities Corporation (BNYMSC), 240 Greenwich Street, New York, NY 10286. BNYMSC, a registered broker-dealer and FINRA member, and subsidiary of BNY Mellon, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Mellon Investment Management firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • Singapore: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Australia: BNY Mellon Investment Management Australia Ltd (ABN 56 102 482 815, AFS License No. 227865). Authorized and regulated by the Australian Securities & Investments Commission. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario.

BNY MELLON COMPANY INFORMATION

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally. • Insight Investment - Insight North America LLC (INA) is a registered investment adviser under the Investment Advisers Act of 1940 and regulated by the US Securities and Exchange Commission. INA is part of 'Insight' or 'Insight Investment', the corporate brand for certain asset management companies operated by Insight Investment Management Limited including, among others, Insight Investment Management (Global) Limited (IIMG) and Insight Investment International Limited (IIIL) and Insight Investment Management (Europe) Limited (IIMEL). Insight is a subsidiary of The Bank of New York Mellon Corporation. • Newton Investment Management - Newton” and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). NIM is incorporated in the United Kingdom (Registered in England no. 1371973) and is authorized and regulated by the Financial Conduct Authority in the conduct of investment business. Both Newton firms are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation.. • ARX is the brand used to describe the Brazilian investment capabilities of BNY Mellon ARX Investimentos Ltda. ARX is a subsidiary of BNY Mellon. • Dreyfus is a division of BNY Mellon Investment Adviser, Inc. (BNYMIA) and Mellon Investments Corporation (MIC), each a registered investment adviser and subsidiary of BNY Mellon. Mellon Investments Corporation is composed of two divisions; Mellon, which specializes in index management and Dreyfus which specializes in cash management and short duration strategies. • Walter Scott & Partners Limited (Walter Scott) is an investment management firm authorized and regulated by the Financial Conduct Authority, and a subsidiary of BNY Mellon. • Siguler Guff - BNY Mellon owns a 20% interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers LLC).

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All information contained herein is proprietary and is protected under copyright law.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

©2022 THE BANK OF NEW YORK MELLON CORPORATION

WM-321839-2022-11-16

GU-333 – 31 December 2023