Over the past few years, the world has experienced a public health crisis, social tensions, technological disruptions and economic turbulence unseen in decades.

BNY Mellon Shifting Horizons Global Family Office Whitepaper

Executive summary

Over the past few years, the world has experienced a public health crisis, social tensions, technological disruptions and economic turbulence unseen in decades. As a trusted partner and advisor to family offices, BNY Mellon Global Family Office partnered with The Harris Poll to find out how this select group was adapting to these massive and rapid interruptions across the globe.

You can read our full report here.

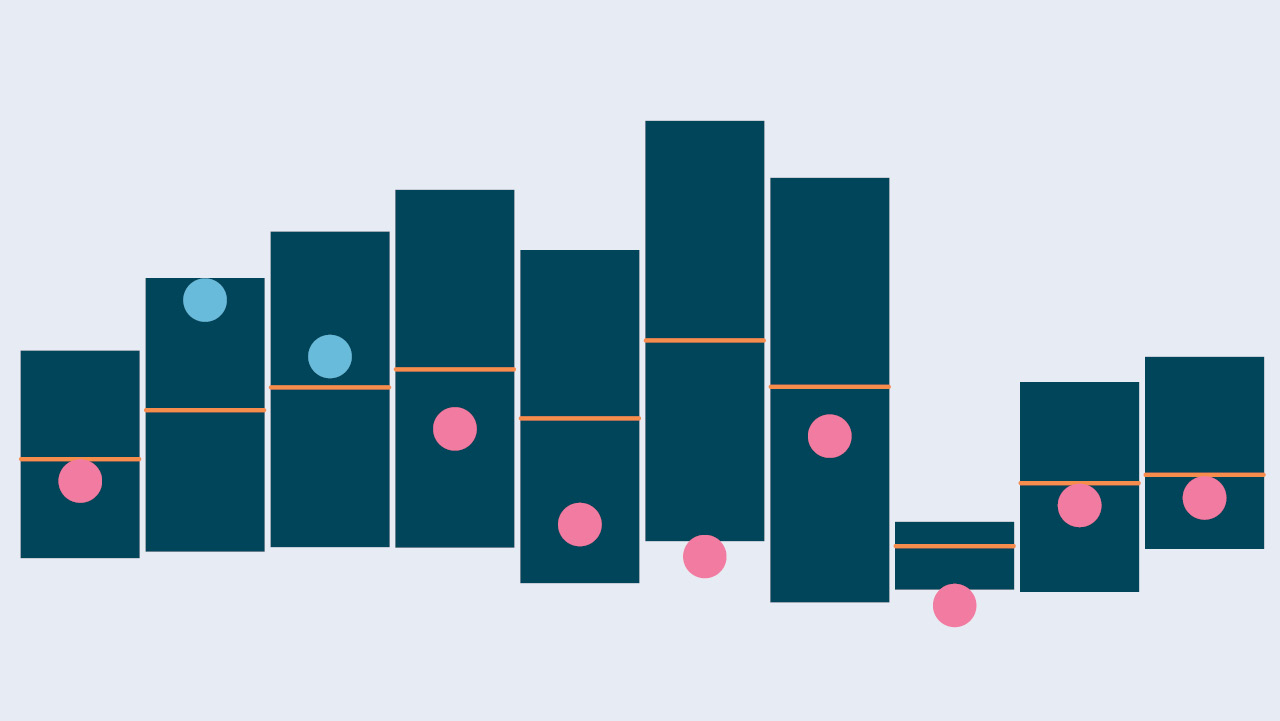

Key takeaways

Philanthropy Management – Nearly three-quarters (73%) of family offices are involved to some degree in philanthropy, with 30% having a documented strategy. Among offices involved in philanthropy, one in five oversee charitable grants of at least $25M.

Next Gen & Succession Planning – Succession planning is viewed as extremely or very important by two out of three (66%) family offices. Many offices admit that they could use external help in succession planning, as finding a trusted partner can be difficult.

Cryptocurrencies – More than three out of four (77%) family offices have at least some interest or involvement in cryptocurrencies. Among those actively investing, four in ten (40%) deem it important to their overall investment strategy and over two-thirds in this group plan to increase their holdings.

Private Banking – Only three in ten (29%) family offices currently facilitate private banking services for their clients, with capital markets (brokerage services, mutual funds), cash management and credit and lending provided most often. When choosing a private banking partner, offices are most interested in up-to-date technology for online banking and mobile access, competitive loan rates and foreign exchange services.

Family Office Regulation – Over eight in ten (81%) perceive increased regulatory oversight on family offices as government intrusion on family finances. Similarly, about eight in ten (78%) perceive governmental oversight as an impediment to family offices’ ability to fund ventures that boost the economy.

To learn the perspectives of 200 family office decision makers across all major geographic regions, please read our full report.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views, insights and positioning statements expressed within this material are those of the 200 Family Office decision makers and not necessarily those of BNY Mellon. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

WM-396837-2023-06-26