Many historical events have helped shape philanthropy and the evolution of impact investing. We present a five-point process for nonprofits to transition to full mission alignment.

Many historical events have helped shape philanthropy and the evolution of impact investing — generating positive social or environmental impacts, as well as solid returns. These events have helped us appreciate a wider stakeholder group and the power of collaboration and investment partnerships. The most recent extreme event, the coronavirus healthcare pandemic, has exposed fractures in philanthropy, policy and for-profit enterprises alike, highlighting inequities in our most vulnerable communities across many measures such as housing stability, access to healthcare, food insecurity and social justice.

To truly succeed, a nonprofit enterprise must solve the needs for which the organization was created. Whether your organization’s mission is to restore life to our oceans, close the achievement gap, eliminate homelessness, or better yet, make deep poverty a thing of the past – your organization must strive to achieve what it set out to do.

Connecting Capital and Purpose

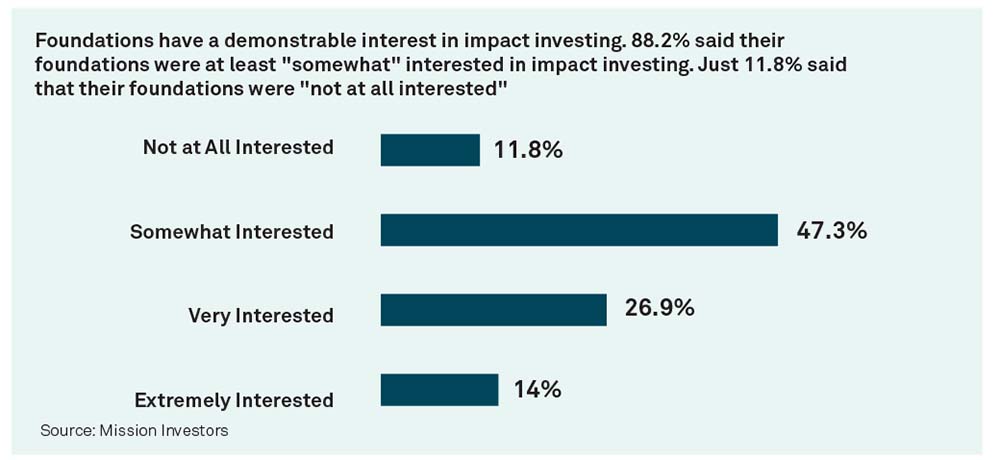

By many accounts, philanthropy is the original incubator of impact investing. As the search for solutions to these pressing issues has become a priority, likewise the desire for foundations to adopt an impact investment strategy continues to grow. According to Mission Investors, more than 88% of respondents are interested in discovering how they can achieve their mission with their investment capital.1

BNY Mellon Wealth Management’s process for a transition to full mission alignment evolved from working with various organizations to develop a new framework that learns from an organization’s history in grantmaking and applying similar outcomes-based rigor to their investment programs. Yet asset selection is just one consideration. There are other decisions that are necessary in creating a mission-aligned impact portfolio.

To effectively leverage your nonprofit balance sheet for purpose, our process offers a new approach to the following practices:

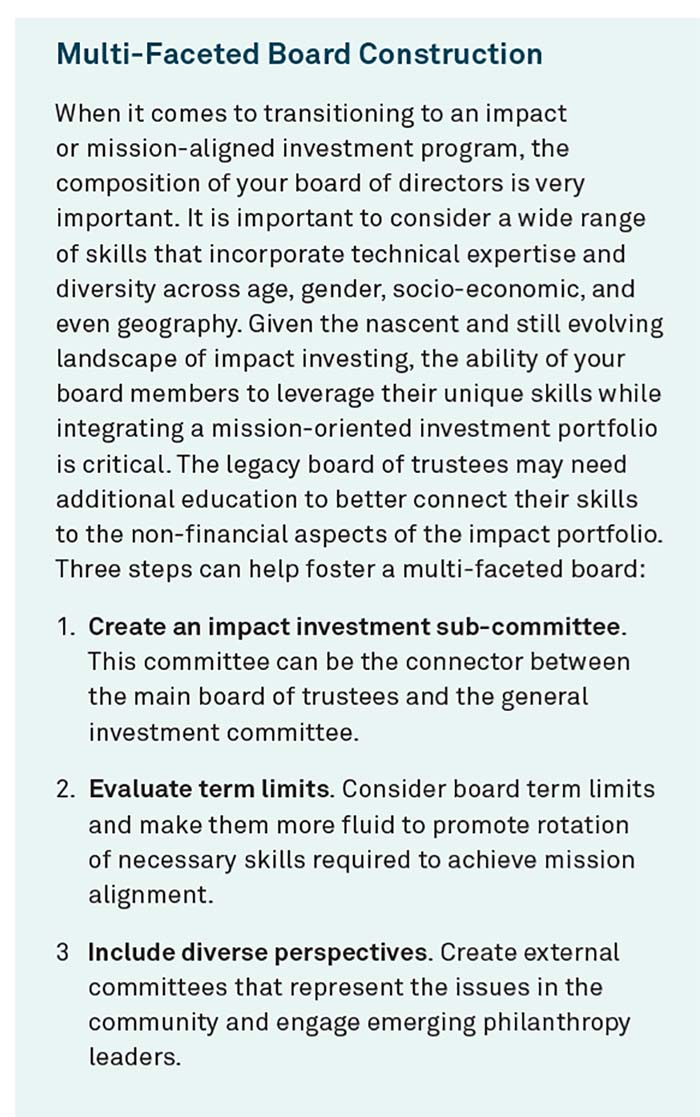

Adaptive Governance – Just like in a for-profit business, sound business principles rooted in governance are a must. For a nonprofit organization, this includes defining the rules for how funds are raised and allocated and deciding on who makes the decisions to allocate.

Governance also addresses the succession plans for an organization. Appreciating the evolution of impact investment is central to continuing the momentum of implementation during the succession of leadership and directors. When considering how your organization allows for space to evolve and innovate, drafting language that clearly defines who the stakeholders are also paves the way for changing legislation is critical, especially in mitigating investment risk.

There is guidance from a wide range of solutions proposed by the Securities and Exchange Commission (SEC) and Employee Retirement Income Security Act (ERISA) in addition to the existing Uniform Principal and Income Act (UPIA)2 and Uniform Prudent Management of Institutional Funds Act (UPMIFA).3

Grantmaking Philosophy – Drawing on your grantmaking and program experience is a crucial component to understanding where an investment program can amplify your impact and mission efforts. Evaluating grantmaking for effectiveness of programs will provide keen insight on whether certain programs and ideas can benefit from a market return generating investment versus a continued grantmaking approach. An example of this is triage grantmaking, which is funding episodically based on an extreme event or a shortfall of basic needs. Metrics for ideas incubated for long-term, system-changing work can be assigned that dovetail with mission-oriented investment portfolio objectives. An investment program for these longer strategic ideas can be effective.

Investment Philosophy and Policy Drafting – Your investment policy should reflect the change in strategy to allow for fiduciary oversight by the investment committee and board of directors. The primary objective of the investment policy is to ensure your strategy does not violate the fiduciary duty of loyalty, duty of care, duty of obedience4 and other factors reflected in the Uniform Prudent Investor Act (UPIA) and the Uniform Prudent Management of Institutional Funds Act (UPMIFA). The policy should provide the guardrails necessary for directors to evaluate investment decisions and understand the risk/return trade-offs.

A best practice is to adopt a transition timeline that best reflects the future state of the portfolio – allowing a runway that matches the investment necessary for your impact- or mission-related theme – across all asset classes. For example, investing for climate action might entail private investments that require minimum holding periods of 10 years or more, whereas other themes, such as housing security or food insecurity, might be met in shorter time frames and with publicly traded debt or equities. Another best practice is to address investments that do harm against your mission and to ensure that you have an action plan for those investments.

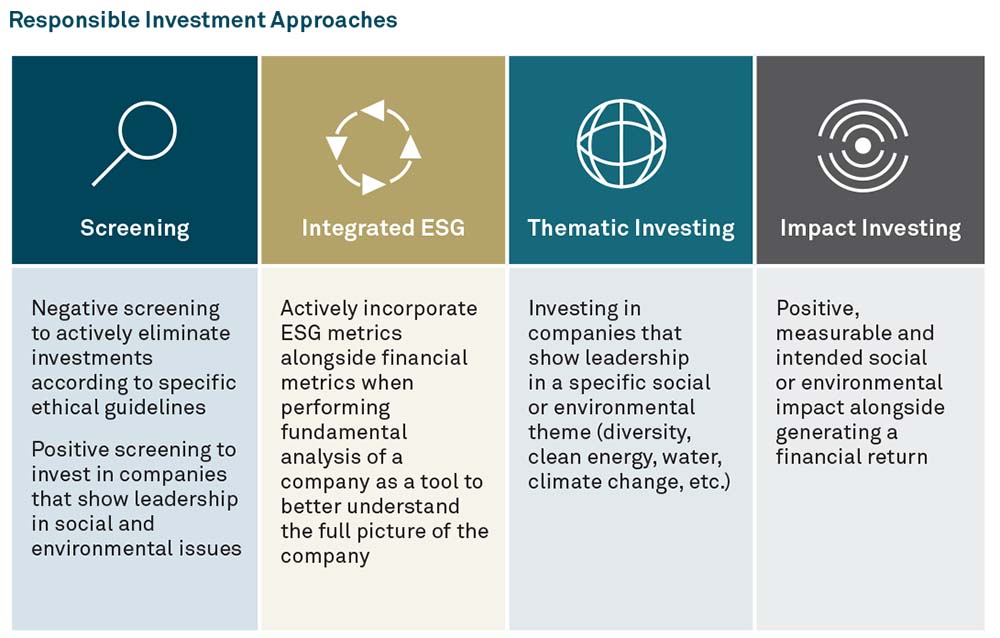

The Principles of Responsible Investing (PRI) defines responsible investment as a strategy to incorporate environmental, social and governance (ESG) factors in investment decisions and active ownership.

External Partnerships – There is not a significant movement or area of change that has been accomplished in isolation. Learning from impact investment programs that worked – and those that did not – before embarking on a strategy is a best practice. As nonprofit organizations seek to optimize impact, leveraging similar mission-oriented enterprises and convening to accelerate change is being increasingly embraced by nonprofits. Where the industry has been hurt by “founder syndrome,” this legacy practice has shifted. Information is readily available, and results are seen in real time. Co-investing in strategies that work to solve shared issues can double the effectiveness of the strategy. A partnership approach can also work to advance legislation in a space that is underfunded related to legal representation. This is particularly important across differing geographies.

Proactive Planning Produces Future Stability

With a paradigm shift underway and philanthropists and nonprofit organizations seeking ways to have meaningful impact – and to also better understand where they might be contributors to harm – putting a process in place that works to educate your staff, board of directors, partners, and all other stakeholders is essential to achieving desired impact outcomes. Creating a framework for a meaningful succession plan will ensure that the mission does not get lost in the eventual changing hands of leadership. Future stakeholders will benefit from this important work.

A PDF of this artcile can be downloaded here.

The Bank of New York Mellon, DIFC Branch (the “Authorized Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE.

The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners.

BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

The information in this paper is as of July 2023 and is based on sources believed to be reliable but content accuracy is not guaranteed.

© 2023 The Bank of New York Mellon Corporation. All rights reserved. | WM-415264-2023-08-11